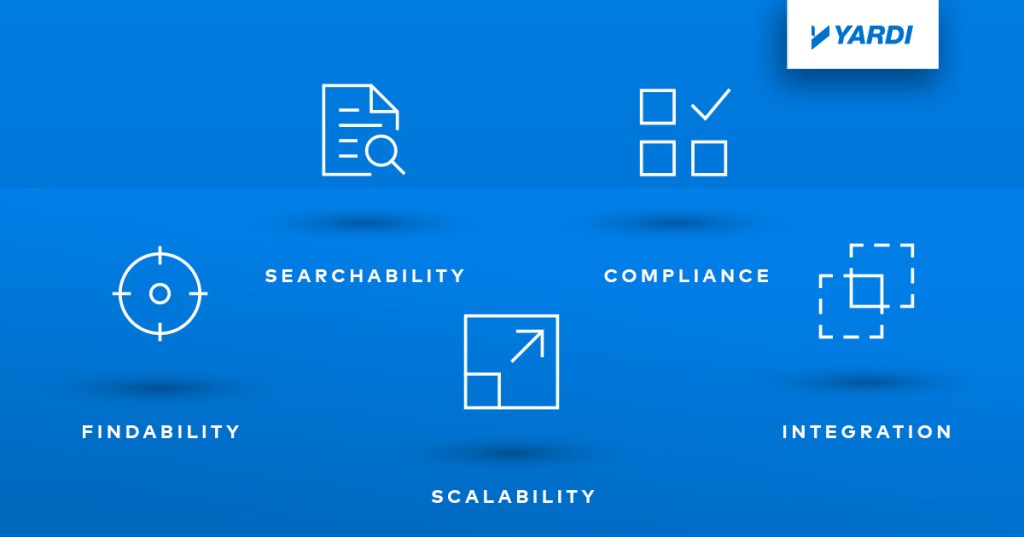

Document Management Musts

Five Features You Need

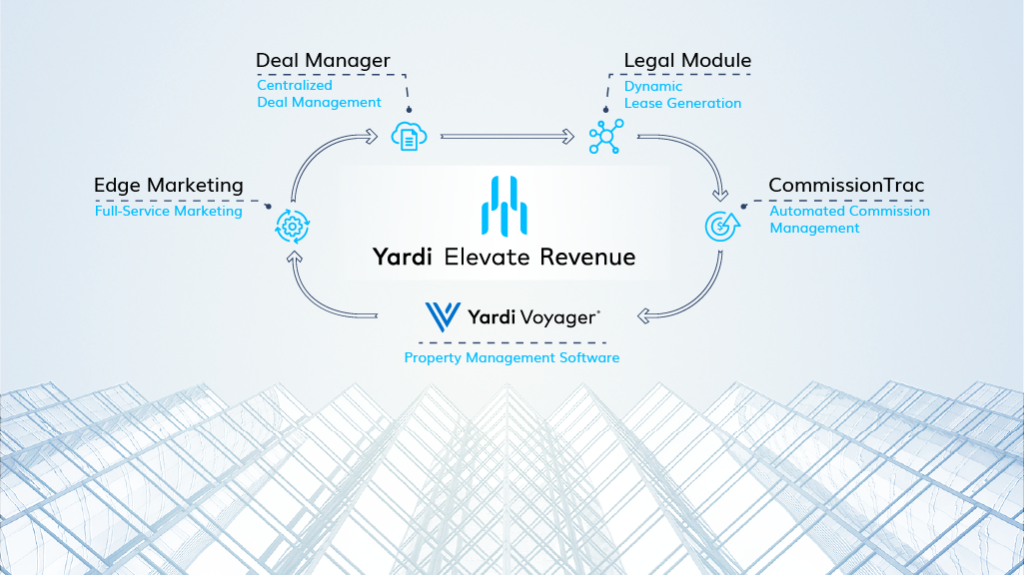

You’re likely familiar with the challenges of managing documents across your business, both for your staff and external users. A few of these challenges include maintaining consistent folder structures, managing security and permissions, integrating content and users, finding documents quickly and tracking multiple versions over time. You can overcome these challenges by storing and sharing […]