ACQUISITION MANAGER

Optimize acquisition & disposition processes

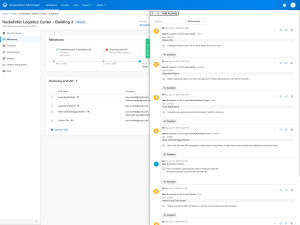

Manage the investment deal pipeline, track activities and transition acquisitions into your portfolio. Improve decision making by centralizing the deal lifecycle.

Features

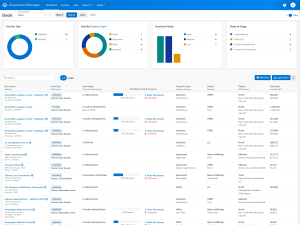

Manage the entire due diligence process in one platform

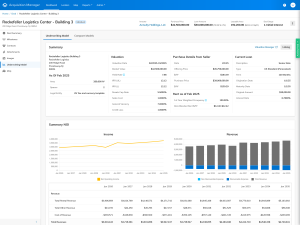

Underwrite deals, model valuation scenarios and analyze projections to optimize cash flow and ROI. Gain accurate property insights from local market data, current leases, loan details and estimated DSCR. Tailor data entry for various asset classes and investment strategies. Track due diligence checklists and deal workflows with real-time updates.

Enhance every step of your deal workflow

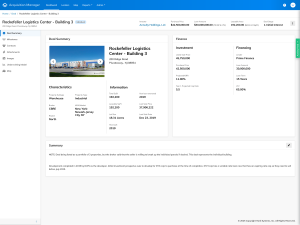

Customize workflows by property type, set milestones with approvals and store all deal-related documents in one secure database or integrate with Microsoft365 SharePoint. Track multiple properties within portfolio deals for a comprehensive view of acquisitions and dispositions. Provide secure access for brokers, lenders, appraisers and counterparties.

Connect with Yardi

Sync finalized acquisitions and dispositions with Yardi Voyager, access commercial property data from CommercialEdge Research and incorporate underwriting models from Valuation Manager for instant projections. Transition completed deals into opportunities in Investment Manager to kick-start capital-raising.

Resources

FAQ

Acquisition Manager helps manage the deal pipeline by centralizing all deal details, documents and activities in a single platform. Designed specifically for real estate professionals, the solution provides real-time deal insights, accurate underwriting models and a structured workflow with milestones and approval tracking. This streamlined approach accelerates deal execution, enhances decision-making and ultimately improves ROI.

Acquisition Manager equips investment and capital markets teams with up-to-date insights on potential commercial and multifamily deals, including property characteristics, last sale price and date, and loan details sourced directly from CommercialEdge and Yardi Matrix. The deal pipeline software also integrates underwriting models from Valuation Manager, enabling in-depth cash flow, NOI and valuation projections for acquisitions and dispositions. This comprehensive approach ensures thorough and timely due diligence, leading to more informed investment decisions

Integrating Acquisition Manager eliminates manual data entry by syncing finalized acquisitions and dispositions in Yardi Voyager. It also streamlines fundraising by seamlessly transitioning completed deals into opportunities in Investment Manager, accelerating capital-raising efforts.

ENERGIZED FOR TOMORROW

We’re here to help

Do more with innovative Property Management Software and services for any size business, in every real estate market.