Markets

MultifamilyCommercialAffordable housingCoworking & flexible spaceInvestment management Manufactured housing PHASelf storage Senior living Mixed portfoliosSee all marketsMarkets we serve

Discover what the right property management tools can do to transform your business.

Solutions

Property Management SoftwareAsset PerformanceCoworking & Flexible SpaceEnergyInvestment ManagementLearningLessee AccountingLeasingMarket ResearchMarketingProcurementSenior CareVoucher ManagementYardi Listing NetworksSee all solutionsTechnology for all real estate professionals

Join thousands of businesses worldwide that choose Yardi property management software and services to optimize every aspect of their operations.

Products

Explore Yardi products

Do more with innovative property management software and services for any size business, in every real estate market. We’re here to help.

Customer Success

VideosSuccess StoriesCase StudiesExplore successes

See how our customers transform their businesses with our solutions.

Company

About UsOur ImpactCareersPress ReleasesNext ChapterHear our story

Our commitment goes beyond connecting companies with customers — it extends to fostering relationships across global communities.

Resources

Resource CenterYardi BlogClient CentralSupportEventsInterfacesIndependent Consultant NetworkPublicationsFind resources

Get answers, access product info, find us at events and browse additional resources to learn more about Yardi.

Multifamily

Provide a frictionless customer experience while improving productivity with a connected property management workflow from customer acquisition to resident retention. Yardi’s innovative multifamily products make it happen every step of the way.

Explore multifamily solutionsMultifamily Solutions

MarketingLeasingProperty management & accountingCustomer experienceAsset performanceInvestment optimizationCommercial

Shorten commercial real estate leasing lifecycles, maximize revenue, gain insight and improve service to your tenants.

Explore commercial solutionsCommercial Solutions

Property management & accountingMarketing & listingsLeasing & deal flowConstruction & developmentTenant engagementFacilities & maintenanceBudgeting & forecastingPerformance & reportingFloorplans & visualizationAffordable Housing

Optimize your affordable housing workflows by consolidating property management, compliance and accounting.

Explore affordable housing solutionsAffordable Housing Products

Voyager Affordable HousingRentCafe Affordable HousingRightSourceVerification ServicesCase ManagerProcure to Pay Suite MatrixLooking for a solution for small to mid-size properties?

Check out Yardi Breeze PremierCoworking & Flexible Space

Drive performance and revenue, reduce costs and grow your coworking space while delivering a phenomenal member experience.

Explore coworking & flexible space solutionsCoworking & Flex Products

Yardi Kube Space Management Yardi Kube Space Management ProYardi Kube IT ManagementCoworkingCafeProcure to Pay SuiteInvestment Management

Manage the entire real estate investment lifecycle with a connected solution. Increase visibility from investor to asset operations.

Explore investment management solutionsInvestment Management Products

Investment Manager Investment AccountingDebt Manager Performance ManagerAcquisition ManagerManufactured Housing

Save time with manufactured housing software that does it all, from tracking homes and lots to accounting, compliance and violations management.

Explore manufactured housing solutionsManufactured Housing Products

MH ManagerRentCafe SuiteProcure to Pay Suite Energy SuiteAspireInvestment SuiteLooking for an easy, all-in-one community management solution?

Check out Yardi Breeze PremierPHA

Thrive with the most advanced platform for agencies, with built-in compliance and mobility for public housing and housing choice vouchers.

Explore PHA solutionsPHA Products

RentCafe PHACase ManagerMaintenance IQVerification ServicesScreeningWorks ProSelf Storage

Do more with facility management software that supports all your accounting, operations, marketing and leasing needs.

Explore self storage solutionsSelf Storage Products

Storage ManagerStorageCafeGoodShieldProcure to Pay Suite MatrixAspireInvestment SuiteLooking for an easy, all-in-one facility management solution?

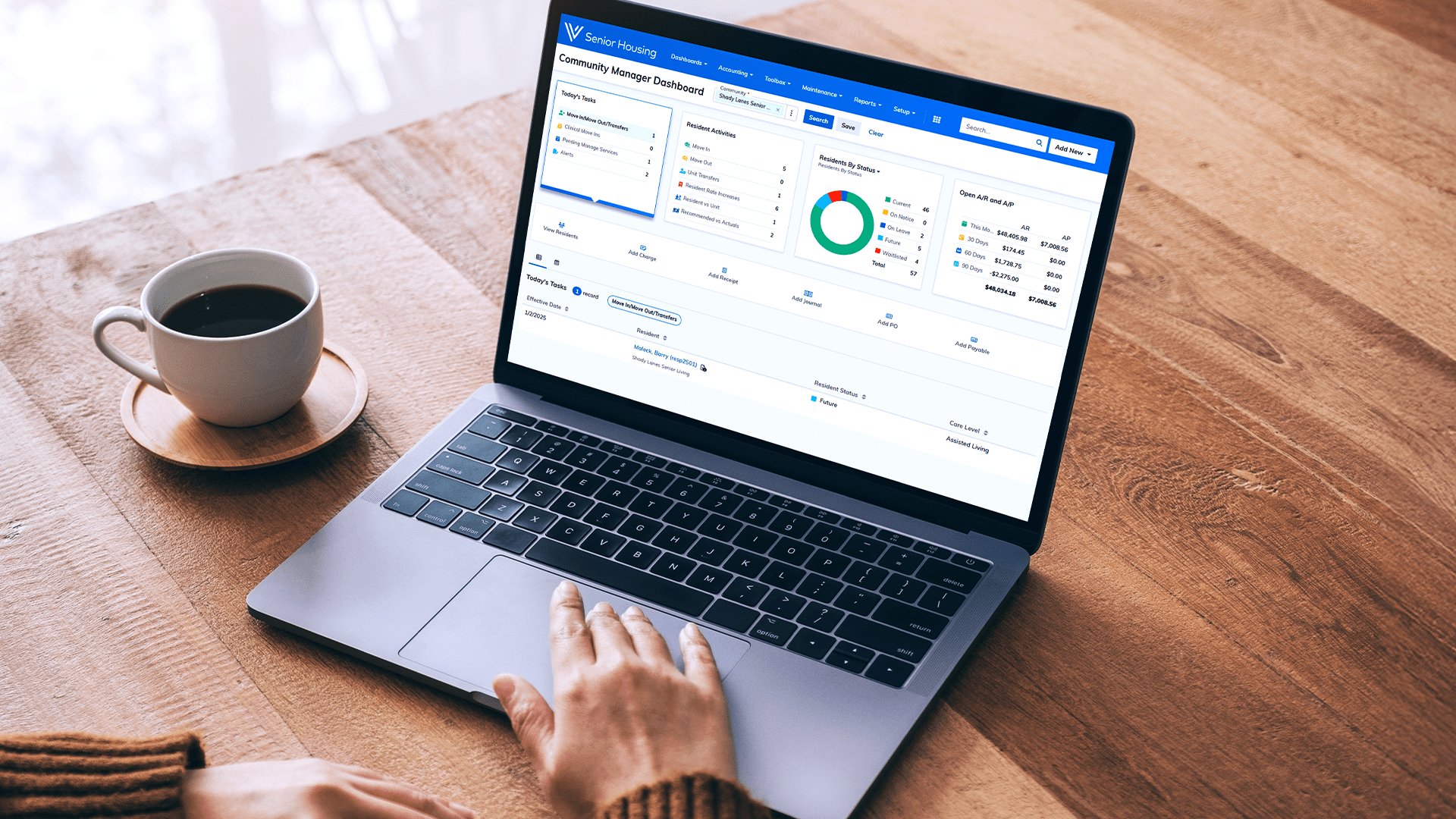

Check out Yardi Breeze PremierSenior Living

Lower your total cost of ownership by managing resident care, finance, operations and marketing with a single software platform.

Explore senior living solutionsSenior Living Products

Voyager Senior HousingSenior IQCare SuiteRentCafe Senior Living Portal Senior CRMProcure to Pay Suite Investment SuiteMixed Portfolios

Streamline your mixed portfolio in a single database with comprehensive tools that work together for all your assets.

Explore mixed portfolio solutionsMixed Portfolio Products

Voyager SuiteRentCafe SuiteCommercialCafe SuiteElevate Suite for CommercialProcure to Pay Suite Energy SuiteAspireInvestment SuitePROPERTY MANAGEMENT

Manage any portfolio type

Choose from two innovative platforms designed for real estate management: Yardi Voyager and Yardi Breeze. Both include accounting, operations and ancillary solutions for residential and commercial portfolios.

Explore property management solutionsProperty Management Products

Voyager SuiteYardi BreezeAsset optimization

Elevate your asset performance

Lower costs, balance risk and increase revenue by combining in-depth operational data and predictive insights with recommended actions.

Explore asset management solutionsResidential Asset Products

Asset IQForecast IQ Revenue IQData ConnectSenior IQCommercial Asset Products

Construction ManagerFacility ManagerFloorplan Manager Forecast Manager Deal ManagerCOWORKING & FLEXIBLE SPACE

Coworking management

Automate your space with all-in-one flexible workspace management to drive revenue, reduce costs and grow while delivering a phenomenal member experience.

Explore coworking & flexible space solutionsCoworking Products

Yardi Kube Space Management Yardi Kube Space Management ProYardi Kube IT ManagementCoworkingCafeEnergy

Improve energy efficiency

Manage energy costs, consumption, efficiency and sustainability with a built-in solution for real estate property management.

Explore energy solutionsEnergy Products

Utility BillingUtility Invoice ProcessingSustainability ReportingEnergy ProcurementEnergy EfficiencyEnergy Reporting & AnalyticsInvestment Management

Achieve investment transparency

Manage the entire real estate investment lifecycle with a connected solution. Increase visibility from investor to asset operations.

Explore investment solutionsInvestment Products

Investment Manager Investment AccountingDebt Manager Performance ManagerAcquisition ManagerLEARNING

Train your team for success

Empower your staff with advanced online learning tools that include training on software, human resources, corporate communications and more.

Explore learning solutionsLessee Accounting

Optimize occupier lease management

Improve efficiency, ensure compliance and reduce risk with a comprehensive lease management solution for occupiers and retail operators.

Explore lessee accounting solutionsLeasing

Convert more leases

Shorten the lead-to-lease lifecycle and transform quality prospects into ready-to-renew leases with a connected management system.

View residential leasing solutionsView commercial leasing solutionsMARKET RESEARCH

Drive business with data

Make smart business decisions faster with comprehensive market and research data that helps identify deals, grow returns and mitigate risk.

Explore market research solutionsResidential Research

MultifamilyAffordable HousingStudent HousingSelf StorageVacant LandCommercial Research

OfficeIndustrialRetailMARKETING

Market like you mean it

Drive leads, leases and renewals with marketing software and services.

Explore marketing solutionsMarketing Products

Residential marketingCommercial marketingPROCUREMENT

Streamline payments & unify procurement

Save money, improve productivity and mitigate risk when you centralize procurement — from purchasing and invoicing to vendor management.

Explore procurement solutionsProcurement Products

PayScanBill PayMarketplaceVendorCafeVendorShieldCare

Deliver better care to seniors

Unify your senior living operations, provide the quality care your residents deserve and enhance your competitive edge.

Explore care solutionsCare Products

EHReMARPharmacy NetworkRentCafe WellnessPROGRAM VOUCHER

Manage all voucher programs

Thrive with the most advanced platform for agencies, with built-in compliance and mobility for all voucher programs.

Explore PHA solutionsPHA Products

Voyager PHARentCafe PHACase ManagerMaintenance IQVerification ServicesScreeningWorks ProYardi Listing Networks

Increase exposure & expand your reach

Syndicate to listing networks across multiple portfolio types. Combine with marketing solutions to get more leads.

Explore listing networksYardi Listing Networks

RentCafe.comCommercialCafe.comCommercialSearch.comCoworkingCafe.comCoworkingMag.comStorageCafe.comProperty Management

Make managing property operations and financials easy with an integrated platform for every portfolio size and type.

See all Voyager productsBy Market

Voyager Commercial Voyager ResidentialVoyager Affordable HousingVoyager PHAVoyager Senior HousingAdd-on Products

Data ConnectDocument Management for SharePointReplicateMaintenance IQFixed Assets ManagerPROPERTY MANAGEMENT

Refreshingly simple all-in-one property management software built for small to mid-sized businesses.

See Breeze & Breeze Premier for USSee Breeze & Breeze Premier for CanadaProperty Types

ResidentialCommercialSelf StorageManufactured HousingAssociationsAffordable HousingAI-POWERED PLATFORM

Conduct the future with Yardi Virtuoso. Our new AI platform uses best-in-class AI models and innovative product development to animate our entire suite of products.

VirtuosoINVESTMENT MANAGEMENT

Manage the real estate investment lifecycle with complete, integrated solution.

See all Investment productsProducts

Investment Manager Investment AccountingDebt Manager Performance ManagerAcquisition ManagerLEASING & RESIDENT EXPERIENCES

Drive leads, leases and renewals while simplifying the move-in journey. All the tools you need to lease and all the services your renters want and need.

See all RentCafe products for multifamilyFor other markets

RentCafe Affordable HousingRentCafe PHARentCafe Senior Living PortalRentCafe Senior CRMRentCafe WellnessDIGITAL MARKETING AGENCY

Attract more renters with help from a full-service marketing agency. Enjoy optimized websites, winning search strategies and total marketing transparency.

See all REACH by RentCafe productsMarketing

WebsitesSearch marketingMarketing analyticsVisual mediaInternet Listing Site

RentCafe.comTENANT SERVICES

Offer tenants a self-service portal and native mobile app to make lease payments, enter maintenance requests and retail sales data online.

See CommercialCafe productsProducts

CommercialCafe Tenant Portal TenantShieldCommercialCafe MarketingCommercialCafe ILSASSET PERFORMANCE

Increase NOI and gain actionable insights with unprecedented visibility into your portfolio.

See all Elevate products for multifamilySee all Elevate products for commercialResidential Products

Asset IQForecast IQ Revenue IQSenior IQCommercial Products

Deal ManagerConstruction ManagerFacility ManagerFloorplan Manager Forecast ManagerSPEND MANAGEMENT

Save money, improve productivity and mitigate risk when you centralize procurement — from purchasing and invoicing to vendor management.

See all Procure to Pay productsProducts

PayScanBill PayMarketplaceVendorCafeVendorShieldENERGY MANAGEMENT & ESG

Manage energy costs, consumption, efficiency and sustainability with a built-in solution for real estate property management.

See all Energy productsProducts

Utility BillingUtility Invoice ProcessingSustainability ReportingEnergy ProcurementEnergy EfficiencyEnergy Reporting & AnalyticsLEARNING MANAGEMENT SYSTEM

Empower your staff with advanced online learning tools that include training on software, human resources, corporate communications and more.

See AspireCOMPLIANCE REVIEWS

Be confident your affordable housing certification files are compliant with all applicable regulations. Save time and prevent errors with fast, digital reviews conducted by our team of experts.

See RightSourceSENIOR CARE

Unify your senior living operations, provide the quality care your residents deserve and enhance your competitive edge.

See all Care productsProducts

EHReMARPharmacy NetworkRentCafe WellnessMARKET RESEARCH

Make smart business decisions faster. Get comprehensive market and research data that helps identify deals, grow returns and mitigate risk.

See MatrixCOWORKING & FLEX MANAGEMENT

Automate your space with an all-in-one flexible workspace management platform. Drive revenue, reduce cost and grow while delivering a first class member experience.

See all Yardi Kube productsProducts

Yardi Kube Space Management Yardi Kube Space Management ProYardi Kube IT ManagementCoworkingCafeSCREENING

Make better renter decisions faster and minimize risk with a proven online tenant screening system that offers quick, comprehensive reports.

See ScreeningWorks ProOCCUPIER LEASE MANAGEMENT

Optimize efficiency, improve compliance and reduce risk with a comprehensive lease management solution for corporate occupiers and retail operators.

See Yardi CoromVideos

See our solutions in action. Watch and learn why top businesses trust our products and services. Explore quick, engaging videos showcasing exactly how Yardi can impact your workflows.

Explore video librarySuccess Stories

Real success, real businesses. Dive into compelling testimonials that reveal the true value and impact of partnering with Yardi.

Explore success storiesCase Studies

Dive deeper into the results. Our detailed case studies illustrate exactly how we've helped clients tackle tough challenges and achieve impressive outcomes.

Explore case studiesAbout Us

Learn more about our story, our people and why property managers worldwide trust Yardi to deliver innovative solutions for real estate success.

See our storyQuick Links

Leadership TeamOur MissionAccolades & AwardsOur Impact

Take care of our clients, take care of our employees, take care of our communities, stay focused and grow. At Yardi, doing good is a year-round passion. For over 40 years, along with our clients, Yardi is proud to have supported thousands of non-profits around the world.

Learn about Yardi.orgYardi Initiatives

EducationEnvironmentHomelessnessHumanitarianIndustryNorth AmericaPune, IndiaCareers

Join a team that's shaping the future. Explore opportunities to grow your career and make an impact alongside passionate, innovative professionals.

Explore a career at YardiCareer links

OpeningsAbout usBenefitsCultureStudentsRecruiting eventsPress Releases

Explore Yardi's latest developments, company achievements and industry impact. Read our official announcements and stay connected.

Explore press releasesLetter from Anant

Discover how Yardi’s values continue to guide our future, with a message from Anant Yardi announcing our next CEO.

Read the letterResource Center

Explore Yardi’s comprehensive library of resources including product brochures, informative webinars, market insights and more — all crafted to help drive success with technology.

Explore the Resource CenterYardi Blog

Explore the latest insights, trends and best practices in real estate technology and management on Yardi's official corporate blog.

Explore Yardi BlogTopics

NewsEventsProduct updatesAILearningTeam YardiClient Central

Licensed clients can take advantage of our continually updated library of training videos, product manuals, release notes and conference materials through this convenient online portal.

Additional utilities allow you to make select adjustments to your Yardi license, keep up with Yardi news and more.

Log in to Client CentralSupport

Yardi is committed to supporting clients with superior services.

View all support servicesTypes

Technical SupportTrainingCloud ServicesImplementationEvents

Find Yardi at events designed to educate, inspire and connect industry professionals. Stop by our booth to meet the team and see what's new.

See all eventsEvents

Industry EventsWebinarsYASCInterfaces

Yardi interfaces service the most vendors, APIs, units and square footage in the industry. We offer several interface solutions to provide our customers with streamlined workflows between Yardi software and certain third-party vendors.

Find an interface partnerBecome an interface partnerLooking for senior living interfaces?

EHR interface vendorsPharmacy networkIndependent Consultants

In addition to our own in-house Professional Services Group, Yardi works with many independent consultants all over the world who can also assist you with implementation and a variety of other services for your Yardi software.

Find a consultantPublications

Explore expert insights, market analyses and industry trends through Yardi's curated collection of articles, white papers and industry publications.

Yardi Publications

Multi-Housing NewsCommercial Property ExecutiveCoworking Mag