Global

Complexity and Challenge

The real estate sector is busy repositioning portfolios, pivoting into new sectors and pouring money into proptech. But will it be enough to meet the elevated demands of building customers in the post-pandemic world? This was the big question behind Bernie Devine’s latest Yardi Proptech Insights webinar. In the fifth instalment of the series for […]

12 / 11 / 21

Building Experiences

Non-fungible tokens, or NFTs, may have been attracting headlines for the eye-watering sums splashed on digital artworks and virtual land. But behind the hype is a digital key that can help the real estate industry create better experiences in their buildings, foster engaged communities and, ultimately, unlock new value. Mars House, a digital home designed […]

12 / 05 / 21

Transparent Data

How will transparent data revolutionise real estate? This was the underlying question for Ben Robinson, CEO of Raffles Quay Asset Management in Singapore, when he sat down with Yardi’s Bernie Devine recently for the latest instalment of Yardi Proptech Insights. Ben oversees the largest integrated mixed-use development at Singapore’s Marina Bay. In real estate terms, […]

11 / 24 / 21

Post-Pandemic CRE Priorities

Canadian commercial real estate tenants and investors are becoming increasingly sophisticated in tracking their assets. Their inquiries are expanding beyond payments and quarterly reports. The overarching theme for the next six to 12 months will be environmental, social and governance (ESG) practices supported by reliable data. To remain competitive, property owners, operators and landlords must […]

11 / 19 / 21

Change Management

An amalgamation of several housing firms presented a unique challenge for one of Canada’s largest social housing providers. Each faction brought its own technology, workflows and data. After nearly two decades of managing disparate systems, it was time for a change. Host Tarun George, manager of Strategic Partnerships and Development, Ontario Non-profit Housing Association (ONPHA) […]

11 / 05 / 21

Canada Checks In

Want to know what Canadian tenants want? Results from the sixth Multifamily Tenant Preference Survey are in! Yardi Canada is a proud sponsor of this annual survey that garnered feedback from more than 36,000 tenants. Survey results were presented by Amy Ericson, Global President, Avison Young Investment Management. Her presentation offers the inside scoop on […]

10 / 18 / 21

Evaluate to Innovate

What’s the best way for a real estate company to flex its innovation muscle? Robust evaluation. That’s the key takeaway straight from two property technology specialists, Cromwell Property Group’s Sean Rowe-Hagans and Yardi’s Bernie Devine. Devine, regional director for Yardi in APAC, caught up with Rowe-Hagans in the latest installment of Yardi Proptech Insights. The […]

10 / 13 / 21

Stronger Together

In Germany, an estimated 51% of men and 43% of women will develop cancer during their lifetime, reports medical research firm Bristol Myers Squibb. While the number of survivors is steadily increasing, so is the number of incidences amongst people of working age. One non-profit organization helps families cope with cancer diagnoses to develop greater […]

Exceptional Resident Experiences

Get Living creates exceptional communities and neighbourhoods across the United Kingdom. Places where people can live their best lives, homes they feel they belong in, and communities they can connect in with people. The team at Get Living understand the important role technology plays in connecting residents to their communities and that delivering exceptional resident […]

09 / 23 / 21

Driving for Net Zero

Every single person in Lendlease’s 11,000-strong team has their sights set on net zero emissions by 2025. It’s a huge undertaking – one which will be impossible without the help of technology and data. This puts Richard Kuppusamy and Helen Lam – two of Lendlease’s digital leaders – in the driver’s seat as they help […]

09 / 22 / 21

Reconfiguring CRE

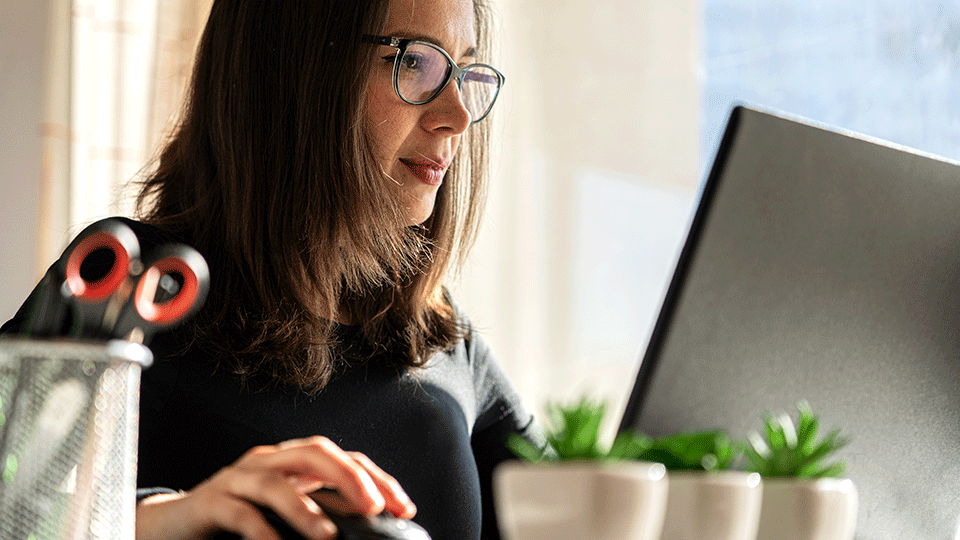

How will the commercial real estate environment in Canada be reshaped as workers gain the option to return to their workplaces? Some clues are already evident. Amid the pandemic’s disruption of economic sectors and lives, it seems that many workers adjusted well to the enforced work-from-home environment. One workplace research study found that nearly two-thirds […]

09 / 16 / 21

Proptech Stars

How do real estate leaders pick proptech winners? Don’t start with technology, start with business strategy, advised Radiant Property Technologies Managing Director Paul Chen in the first instalment of Yardi’s Proptech Insights webinar. The property technology universe, once studded with a handful of stars, is now strewn with countless constellations. Technologies from artificial intelligence to […]

08 / 23 / 21

Tech Investment

Millions of Canadians count on the social housing sector to provide them with accessible housing resources and services. Organizations like the Canadian Housing and Renewal Association (CHRA) and Ontario Non-Profit Housing Association (ONPHA) work closely with local providers to advocate for and assist this underserved population, despite working within tight budgets. This sector’s resiliency has […]

06 / 10 / 21

One Team, One Dream

When Yardi expanded to the Asia Pacific (APAC) market 15 years ago, it entered uncharted territory. Supporting a new team more than 11,000 miles away from the Santa Barbara headquarters required creativity, cultural savvy, a bold sense of exploration—and of course, technology. Since then, the Yardi Systems Pty Ltd. has established itself as a trusted […]

Informed Decisions, Better Results

The most successful companies are those that utilize data and analytics as a supporting tool to adapt to rapid market changes, but how can you simplify Big Data to improve daily decision making? How can online services help you stay connected while safely doing business miles apart? There are innovative solutions that offer a combination […]

06 / 02 / 21

ENERGIZED FOR TOMORROW

We’re here to help

Do more with innovative Property Management Software and services for any size business, in every real estate market.