Intense climate and weather-related events, such as hurricanes, hail and ice, heat a nd wind and inland flooding, are occurring around the world with alarming intensity. Three hurricanes in 2017 alone caused a combined $300 billion in damages. About 5 million people in the U.S. are within 4 feet of a local high-tide level.

nd wind and inland flooding, are occurring around the world with alarming intensity. Three hurricanes in 2017 alone caused a combined $300 billion in damages. About 5 million people in the U.S. are within 4 feet of a local high-tide level.

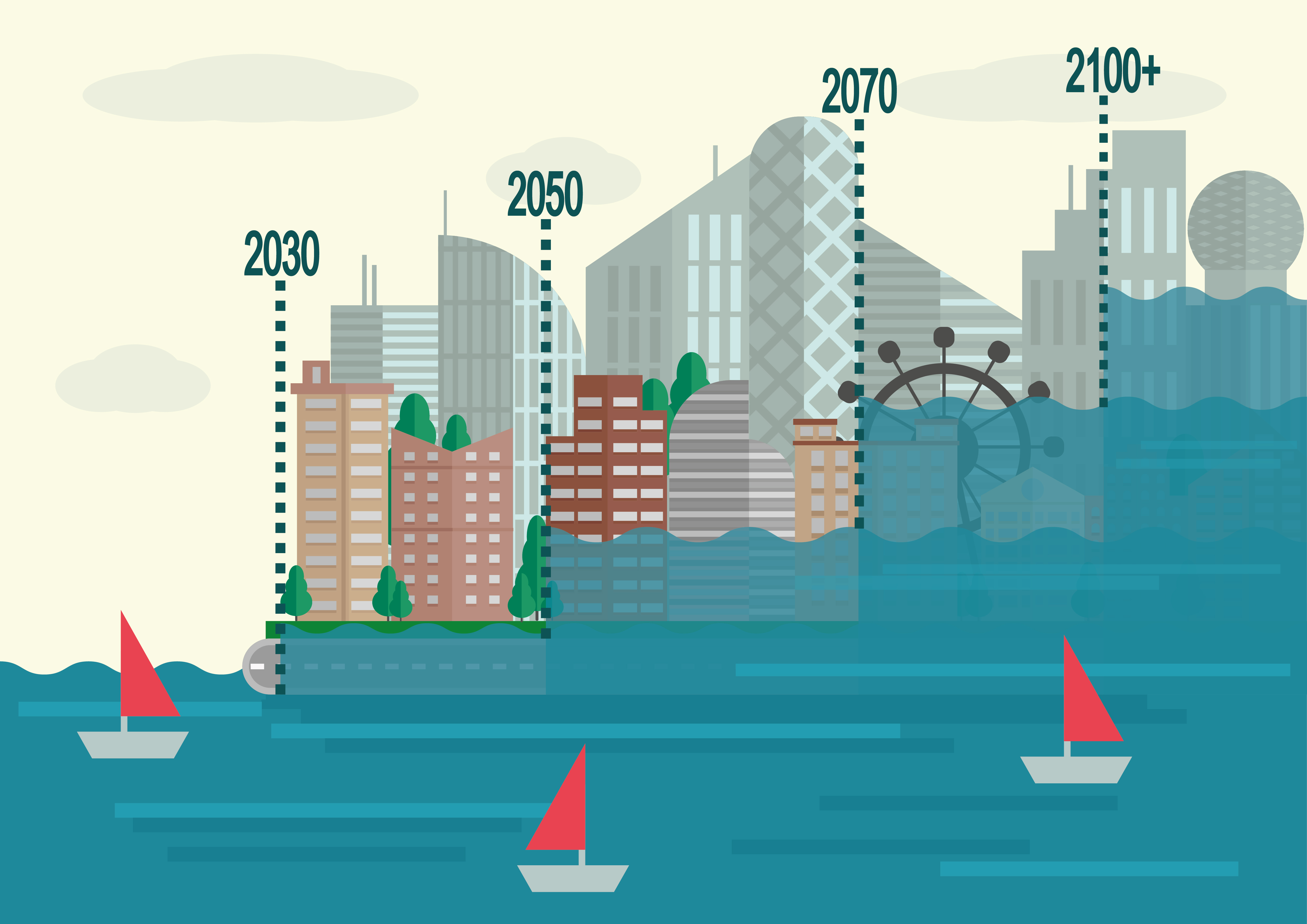

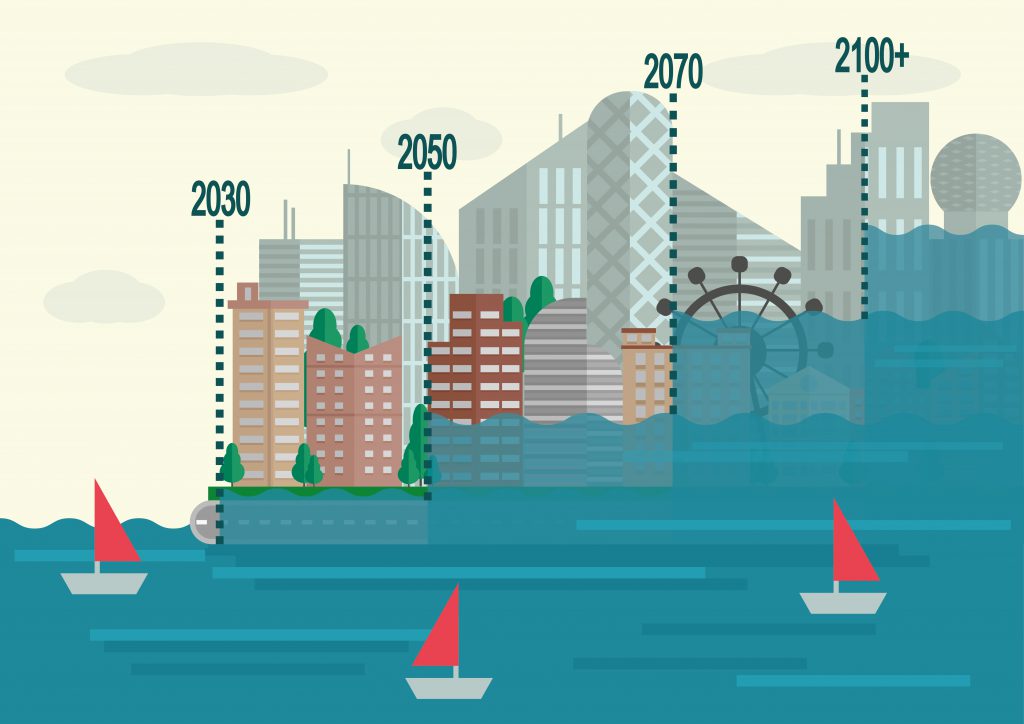

A United Nations report in 2016 noted that climate-related events could place real estate assets valued at $35 trillion at risk by 2070—about half of today’s global assets under management in any industry sector. By one estimate, a sea level rise of six feet would imperil U.S. coastal properties worth about $900 billion.

How can real estate asset managers prepare for what could be an inevitable rise in sea levels and other manifestations of climate change?

“Asset managers and investors already have access to energy efficiency data from providers like Yardi. Now they need project-level natural hazard data that includes climate change projections. This is something the climate resilience field is working on, with a variety of firm jockeying to be first with the rollout of their proprietary software,” says Joyce Coffee, president of Climate Resilience Consulting and a senior sustainability fellow at Arizona State University’s Global Institute of Sustainability.

Some cities, such as Cedar Rapids, Iowa, are countering weather damage risk by building flood control systems. Other metros, like Philadelphia, Detroit and Washington, D.C., have increased sewage fees, spurring building owners to consider adopting more stringent water conservation efforts. Many other officials and private citizens, of course, focus their efforts on identifying and mitigating sources of climate change.

Real estate investors, for their part, are incorporating climate risk into their analysis and avoiding risky investments.

A whitepaper released by BlackRock in 2016 noted, “Investors can no longer ignore climate change. Some may question the science behind it, but all are faced with a swelling tide of climate-related regulations and technological disruption. Our overall conclusion: We believe all investors should incorporate climate change awareness into their investment processes.”

That appears to be happening. “While my climate resilience colleagues often ask where we can find financing for climate resilience, [BlackRock and other] real estate investment managers brought a fresh spin to the money question: How can we avoid future investments in risky properties? Both questions are valuable, and it’s great to see some in the real estate industry ‘thinking in public’ about how to make this market transformation happen,” says Coffee, a frequent speaker at real estate industry events including a Yardi executive briefing.