Elevate Revenue

A Way to Optimize Returns

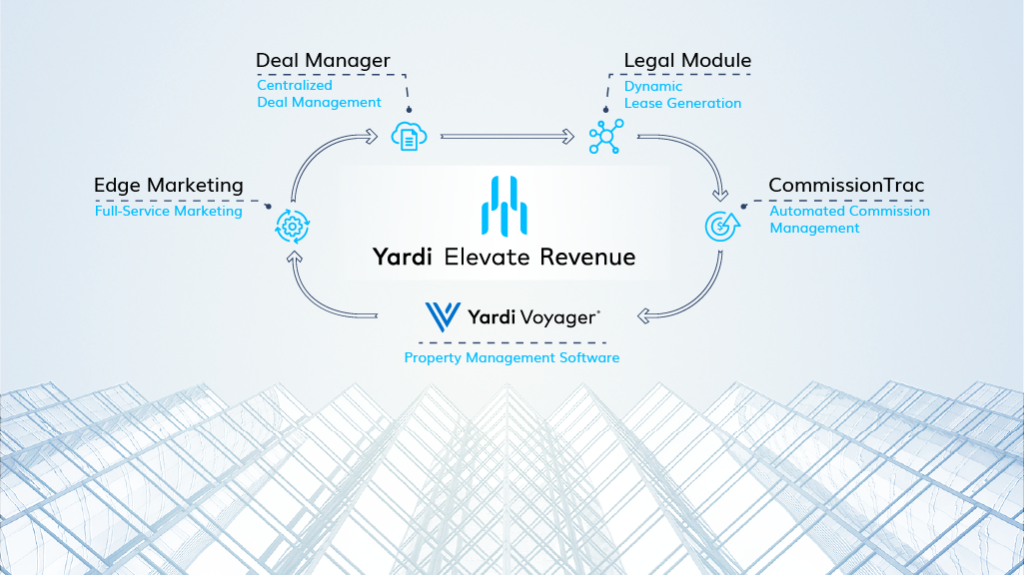

Yardi has launched Elevate Revenue, a CRE solution stack that streamlines the entire deal lifecycle from lead to lease. Specifically intended for owners, asset managers and leasing teams, the all-in-one solution was designed in collaboration with commercial experts and industry leaders. The end-to-end portfolio management suite, supported by decades of real estate research and software […]