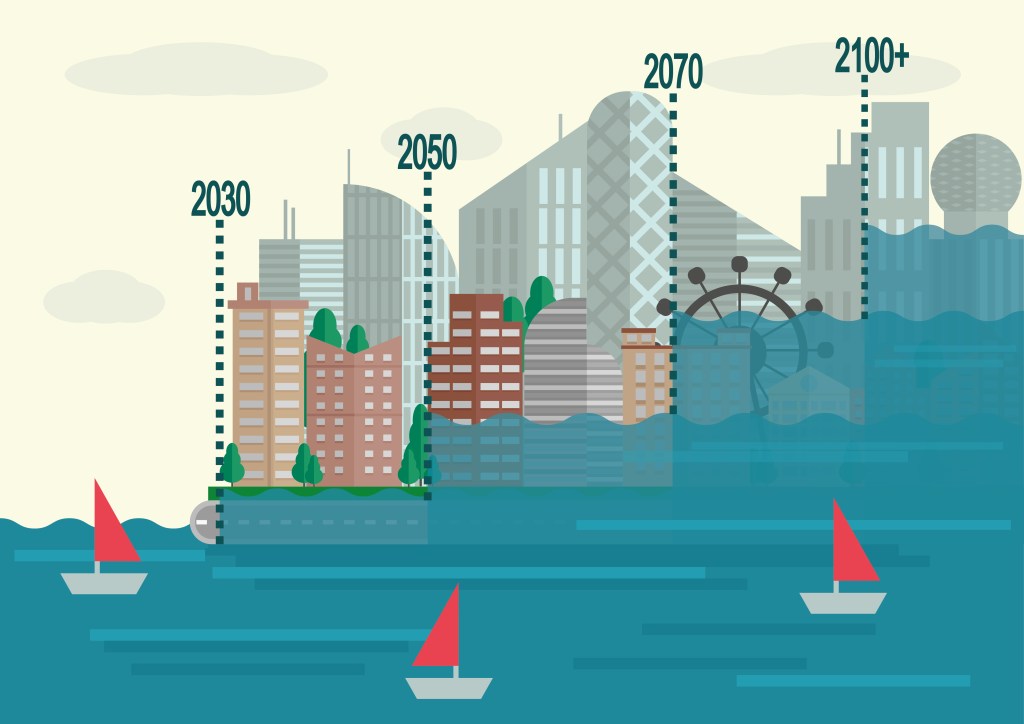

Rising Concern

Sea Level Impact on Real Estate

Intense climate and weather-related events, such as hurricanes, hail and ice, heat and wind and inland flooding, are occurring around the world with alarming intensity. Three hurricanes in 2017 alone caused a combined $300 billion in damages. About 5 million people in the U.S. are within 4 feet of a local high-tide level. A United […]