By Yardi Blog Staff on April 10, 2017 in Uncategorized

With winter now behind us, property management staff must now prepare for what looks to be a busy spring leasing season. More than ever, management companies are using screening data to maximize the number of potential leases, negate financial risk, and keep their communities safe. Data aggregated by Yardi Resident Screening forecasts a greater chance for higher occupancy and stronger tenant performance this spring due to increased application traffic, job growth, and continued improvement of applicant credit quality.

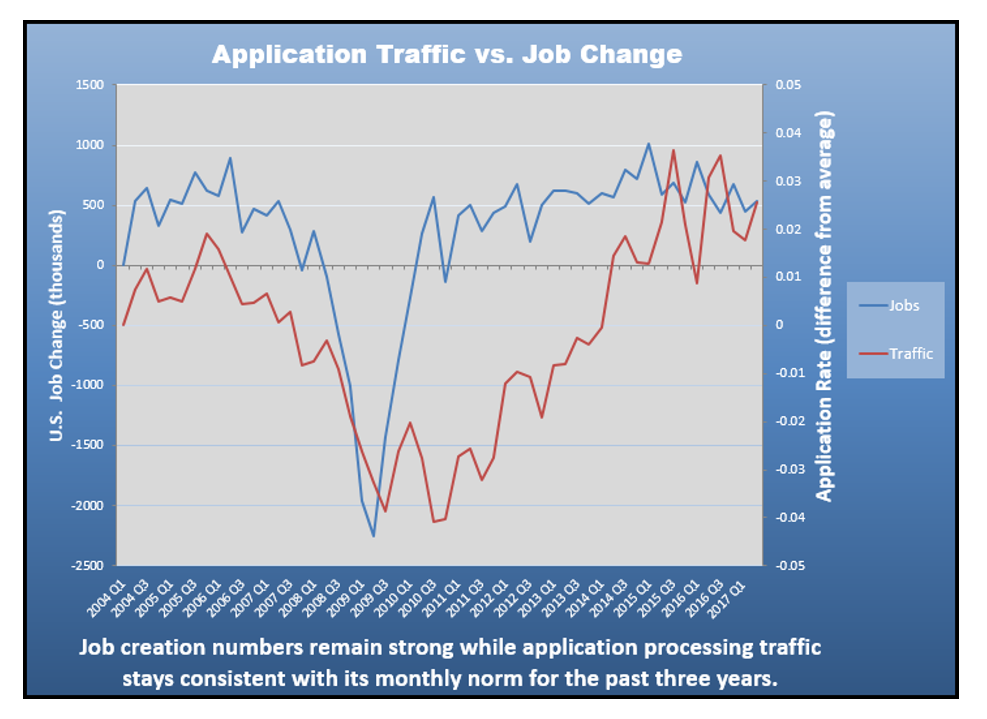

Application Traffic vs. Job Change

The below graph shows the correlation between job change (blue line) and application traffic (red line). As jobs are created, application traffic tends to increase, which indicates that when people are employed and feel financially stable, they will consider moving to a larger unit or luxury community.

The sharp decline in 2008-2009 represents the time frame when the economy bottomed out and went into a recession. Now, with a recovering market and more available jobs, potential renters are looking for better places to live. In addition to this, property management companies can continue to cast a wider net when filling units due to long-time homeowners looking to downsize, and a millennial generation that is still avoiding the permanence of home ownership.

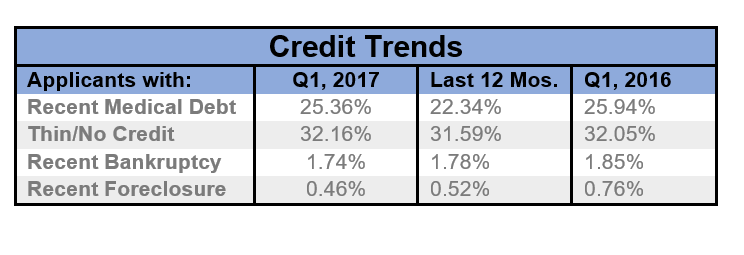

Credit and Screening Performance Trends

Overall, credit quality is improving which means there are less instances of medical debt, foreclosures, and bankruptcy on an applicant’s credit report. Data shows an increase in potential renters with thin or no credit signifying that millennials are still a mainstay in the applicant pool.

Other factors leading to positive credit trends can be attributed to longtime homeowners selling their homes to move to apartments. Downsizing from home ownership to renting an apartment provides less upkeep responsibility and more flexibility in lifestyle. This pool of more experienced applicants tend to bring in better credit quality and higher income.

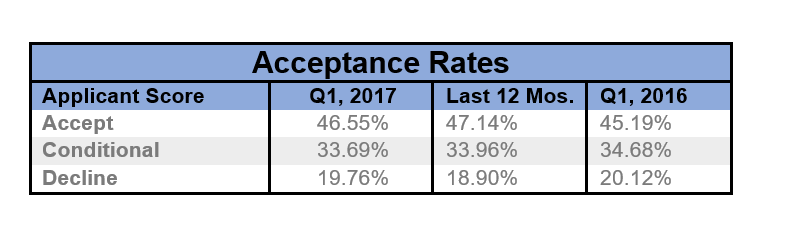

The positive trends in the credit pool show a direct correlation with improvements in overall screening performance percentages. Acceptances are on the rise while application denials continue to shrink.

So, what does this all mean for property management companies?

Now is the time to review your screening criteria in preparation for the upcoming spring leasing season. Yardi Screening’s team of experts work with property management companies to fine tune screening criteria using a combination of demographic data, bad debt and industry trends to forecast performance. Though regions and markets may vary, there is an overall movement in which clients have been tightening up criteria due to increased application traffic, occupancy, and credit quality.

With data showing an increase in less experienced renters we encourage our clients to work with our team of experts to measure performance within this demographic. For example, in the past, “no credit” was thought of as “good credit,” but analytics from recent years have indicated this is never a guarantee.

Aggregate Yardi Screening data shows that applicants with no credit experience attributed to an average of 15% of all bad debt and on average these tenants left their lease owing $2,397. Since applicants with no credit come with an added layer of unpredictability, the majority of management companies have shifted from asking for a standard deposit to needing an extra deposit, co-signer, or both.

With past data being a strong predictor of future performance, our team of dedicated screening experts are ready to assist clients looking to leverage their screening analytics. Clients looking to dive into data find the Yardi Resident Screening Executive Dashboard to be a powerful tool.

To monitor changes in your portfolio, Yardi Resident Screening has added new enhancements to reporting in the Executive Dashboard. For instance, a newer report called “Property Performance” shows application traffic, basic demographics, and breaks down the properties’ accepted, conditional, and rejection rates.

Make this spring leasing season a successful one!

Note: Information for the jobs report is taken from the U.S. Bureau of Labor Statistics and application traffic is aggregate data from the entire Yardi Resident Screening portfolio