By Yardi Blog Staff on July 16, 2014 in News

The real estate landscape is in constant evolution, with developers always on the lookout for smart investment opportunities. Whereas the direction of new development efforts is dictated by a combination of factors, including market conditions, economic considerations and demographic trends, quality infrastructure systems act as a platform supporting real estate growth across the globe.

infrastructure systems act as a platform supporting real estate growth across the globe.

According to a recent report issued by the Urban Land Institute in collaboration with EY, solid infrastructure – including transportation, utilities, and telecommunications – makes the commercial real estate sector tick, along with consumer demand and workforce skills. Infrastructure 2014: Shaping the Competitive City aims to shed light on the role of infrastructure in the development of healthy communities.

The eighth in a series of reports examining infrastructure trends and issues, the ULI/EY analysis was released at ULI’s 2014 Spring Meeting in Vancouver, British Columbia. Conducted in January 2014, the survey mirrors the opinions of 241 public sector officials and 202 senior-level real estate executives (developers, investors, lenders and advisers) in large and mid-sized cities all over the world, with concentrations in the United States, Europe and Asia Pacific. About 86 percent of survey respondents were based in the United States.

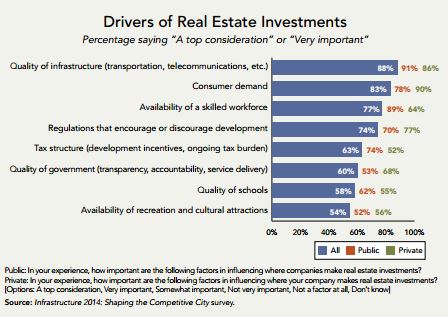

According to the report, the majority of public leaders (91 percent) regard infrastructure quality as the top influencer of real estate investment and development decisions. Infrastructure was rated as second to highest by private leaders (86 percent). Meanwhile, the private sector (90 percent) viewed consumer demand as the top feature determining investment locations. Government service – regulations, tax structure, and quality – fell in the midst of influencing factors for both public and private respondents.

“This survey indicates a growing awareness among the public and private sector of the importance of investments in a variety of transportation systems, including ‘active’ transportation that offers an alternative to constant car use,” said ULI Chief Executive Officer Patrick L. Phillips. “We have entered a new era that requires new approaches to funding and building infrastructure to support the creation of communities that are healthier, more livable, economically prosperous, and environmentally sustainable.”

Howard Roth, EY’s Global Real Estate Leader, added, “Helping stakeholders better understand the importance of developing and maintaining infrastructure, and providing a clear vision of what those infrastructure investments can accomplish are critical.”

Strong telecommunications systems and connectivity (including high-speed internet capability) led the list of infrastructure categories that guide investment flows, in conjunction with good roads, bridges, and reliable and affordable energy.

Other key findings of the survey include:

- Public transit emerged

as a strong priority for future investment. Seventy-eight percent of survey respondents’ said public transit systems, including bus and fixed-rail systems, should receive top priority for infrastructure improvements, followed by roads and bridges (71 percent) and pedestrian facilities (63 percent).

as a strong priority for future investment. Seventy-eight percent of survey respondents’ said public transit systems, including bus and fixed-rail systems, should receive top priority for infrastructure improvements, followed by roads and bridges (71 percent) and pedestrian facilities (63 percent). - Investment priority rankings tended to be the inverse of quality perceptions, with only 48 percent of survey respondents ranking public transit as “good” or “very good” in quality, and 51 percent saying sidewalks and pedestrian facilities were good or very good.

- Roads and bridges received modest quality marks according to the report, with 60 percent of respondents rating them good or very good. (By contrast, 90 percent of respondents said health care facilities were good or very good, placing these facilities at the top of the quality list.)

The public’s willingness to pay for infrastructure ranked as the top factor shaping both infrastructure and real estate development over the next decade, followed by consumer demand for compact, walkable development, and the prevalence of families with children. The cost and availability of energy and the use of innovative pricing systems to fund, manage, and operate infrastructure also ranked high in importance.

The survey further highlighted the need for cooperation between developers and local governments, with three-quarters of respondents ranking public–private partnerships as the most prevalent funding approach for new infrastructure. Other strategies that require collaboration between real estate and civic leaders – including value capture and negotiated exactions – also top the list of likely infrastructure funding sources.

Nevertheless, despite the high ratings for these strategies, the report notes that they are limited in their ability to fund infrastructure at a systematic level, and they are not effective in all contexts. All funding strategies offered in the survey – including contributions from federal and state governments – received relatively strong responses, suggesting the need for a range of funding options. According to EY’s Global Infrastructure and Construction Leader Malcolm Bairstow: “real estate and civic leaders must work together to find more creative and collaborative ways to articulate benefits and overcome funding challenges on infrastructure developments, as this is critical to stimulating long-term economic development.”

Respondents were also skeptical when of the level of preparation by local governments for long-term operations and maintenance of infrastructure. Overall, 30 percent of survey respondents said that long -term operations and maintenance are usually neglected; 72 percent said that operations and maintenance are considered only some of the time or not at all. Private sector respondents were much more pessimistic about this than public sector leaders; and respondents from outside the U.S. had a more positive view than those in the U.S.

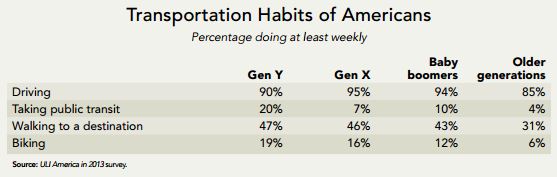

Infrastructure 2014: Shaping the Competitive City includes an interview with Gabe Klein, former transportation chief for Washington, D.C., and Chicago. Klein also served as a regional vice president for Boston-based car-sharing company Zipcar from 2002 through 2006. He is known as a strong promoter of pedestrian-friendly infrastructure and concentrated many of his efforts on launching initiatives to make cities less car-centric. Klein talked about the current state of affairs and future evolution of urban transportation systems and the undeniable impact of infrastructure on attracting or retaining residents. He sees tremendous benefits in promoting “soft” transit options (such as bike lanes) as a supplement to traditional transit systems such as heavy rail or bus lines.

Infrastructure 2014: Shaping the Competitive City includes an interview with Gabe Klein, former transportation chief for Washington, D.C., and Chicago. Klein also served as a regional vice president for Boston-based car-sharing company Zipcar from 2002 through 2006. He is known as a strong promoter of pedestrian-friendly infrastructure and concentrated many of his efforts on launching initiatives to make cities less car-centric. Klein talked about the current state of affairs and future evolution of urban transportation systems and the undeniable impact of infrastructure on attracting or retaining residents. He sees tremendous benefits in promoting “soft” transit options (such as bike lanes) as a supplement to traditional transit systems such as heavy rail or bus lines.

“The investment by cities in cycling infrastructure, wider sidewalks and streetscapes has reinvigorated urban economies by creating a sense of place, and essentially putting back in place what made cities attractive to residents in the first place,” Klein said.