By Suzann D. Silverman on February 8, 2013 in News

The growing incidence of extreme weather poses a range of risks for commercial and residential properties—and one of the most underestimated is wind. Particularly with so much property being built along the coasts, dollar losses to wind are increasing at a rapid rate, catching up to the historically predominant risk for fire.

The growing incidence of extreme weather poses a range of risks for commercial and residential properties—and one of the most underestimated is wind. Particularly with so much property being built along the coasts, dollar losses to wind are increasing at a rapid rate, catching up to the historically predominant risk for fire.

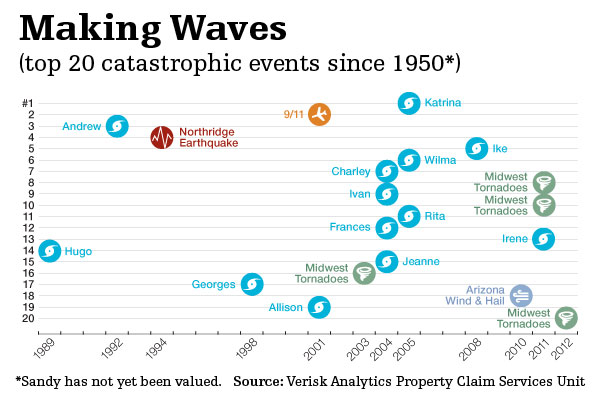

Indeed, according to risk-assessment service provider Verisk Insurance Solutions, 18 of the top 20 catastrophes to impact the United States since 1950, based on total cost, have involved wind damage (all but the terrorist attacks on Sept. 11, 2001, and the Northridge earthquake)—and most of them took place within the past few years. That does not even take into account Hurricane Sandy, whose damage costs are still being evaluated. The increased risk is due to a combination of intensified weather patterns in recent years and the growth in construction in wind-prone areas that historically had a much thinner proliferation of commercial properties—according to Verisk, almost 40 percent of insured value nationwide today is in coastal counties, with that number at almost 60 percent for New York State and 80 percent for Florida.

Given the extensive list of possible losses from wind, property owners and managers would do well to take some precautions. After all, any breach in the building envelope can result in damage to the property itself or its contents—whether it be as extreme as the lifting of the roof in a tornado or a broken window or door that permits entrance of water. And loss doesn’t stop with damage to the building and its contents; debris removal adds to the expense, and the material may not even be from your own building. The exit of harmful chemicals from an industrial site can cause environmental damage. And both business interruption and business continuity efforts can add to the expense, both for building owners and occupants and supply-chain members many miles away.

Owners and managers of existing buildings, especially those in high-risk areas, should inspect their properties with these possibilities in mind. Everything from the height of the building to the shape of the roof, from the amount of glass in the envelope to construction of neighboring buildings to the surrounding topography can impact a property’s vulnerability, according to experts at Verisk, but even simple corrections and maintenance can be beneficial.

Corrections may include replacing windows with impact-resistant glass or installing hurricane shutters, while the list of ongoing inspections should have on it the condition of the roof (a loose corner of the flashing can be enough to allow a breach in a severe windstorm) and how well rooftop HVAC and other equipment is fastened down. That could become a bigger concern as owners and managers whose buildings were flooded during Sandy consider higher placement of tanks and other equipment that has traditionally been kept in the basement. Solar panels, too, can cause damage if they are not installed properly: The wrong angle or a loose fastening can have devastating results.

If fire loss is any indication, wind loss can be brought under control despite the increasing incidence of weather events. While fire remains the greatest source of property loss, risk levels have flattened as efforts at prevention and mitigation have improved. Verisk experts believe both municipalities and developers themselves are moving in the right direction with wind-damage protection. With continued vigilance, damage from this quadrant, too, might be brought under better control.

Suzann Silverman is editorial director of Commercial Property Executive. A more extensive discussion with Verisk Insurance Solutions commercial property vice president Mory Katz and assistant vice presidents Kevin Kuntz and Steve Clarke about the risks to properties from wind, along with a map measuring levels of risk around the country, appears under the heading “Blowing in the Wind” in the February 2013 issue of CPE.