By Vianna Mabanag on December 10, 2025 in Multifamily ScreeningWorks Pro Technology

What is synthetic fraud?

Synthetic fraud occurs when criminals create fake identities by combining real and fabricated information — such as a legitimate Social Security number with a false name — to pass a tenant screening. Or where the name, date of birth and Social Security number do not match a real person. Unlike identity theft, which uses an actual person’s identity, synthetic identities are often harder to detect because they don’t belong to a real individual.

According to experts like SentiLink, synthetic fraud is one of the fastest-growing financial crimes in the U.S., costing industries billions annually. For multifamily operators, the risk is significant: fraudulent applicants can lead to unpaid rent, property damage and costly evictions.

Why it’s a growing concern in multifamily

The multifamily industry relies heavily on digital applications and remote leasing processes, which fraudsters exploit. Once a synthetic identity passes screening, operators may face months of unpaid rent before discovering fraud, which often ends in an eviction. With eviction costs averaging $7,500 per case, the financial impact is staggering.

Yardi stops fraud before it starts

At Yardi, we take fraud prevention seriously. Our ScreeningWorks Pro suite uses advanced analytics and proprietary fraud detection tools to identify suspicious patterns before leases are signed. This is best understood through the data. In a 60-day snapshot, our technology delivered these results:

✔️ 1,042,350 screenings completed (that’s 17,372 per day)

✔️ 530 fraudulent applications flagged (a little over 3% of all applications)

✔️ $4 million in potential eviction costs saved (based on the average eviction cost)

See your numbers & decide your actions

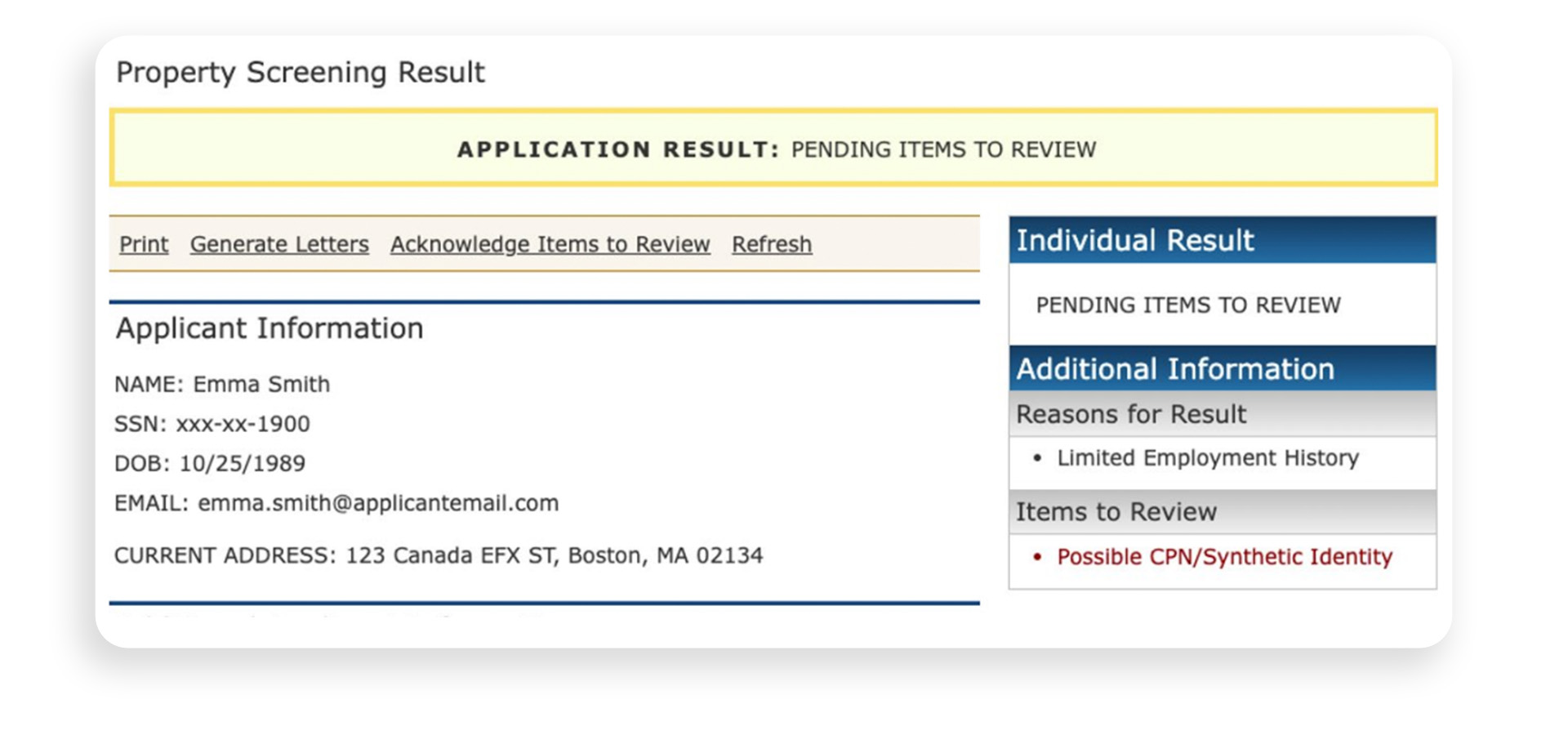

ScreeningWorks Pro alerts you to applicants flagged for potential synthetic fraud, giving you the control to review each case and decide whether to move them forward.

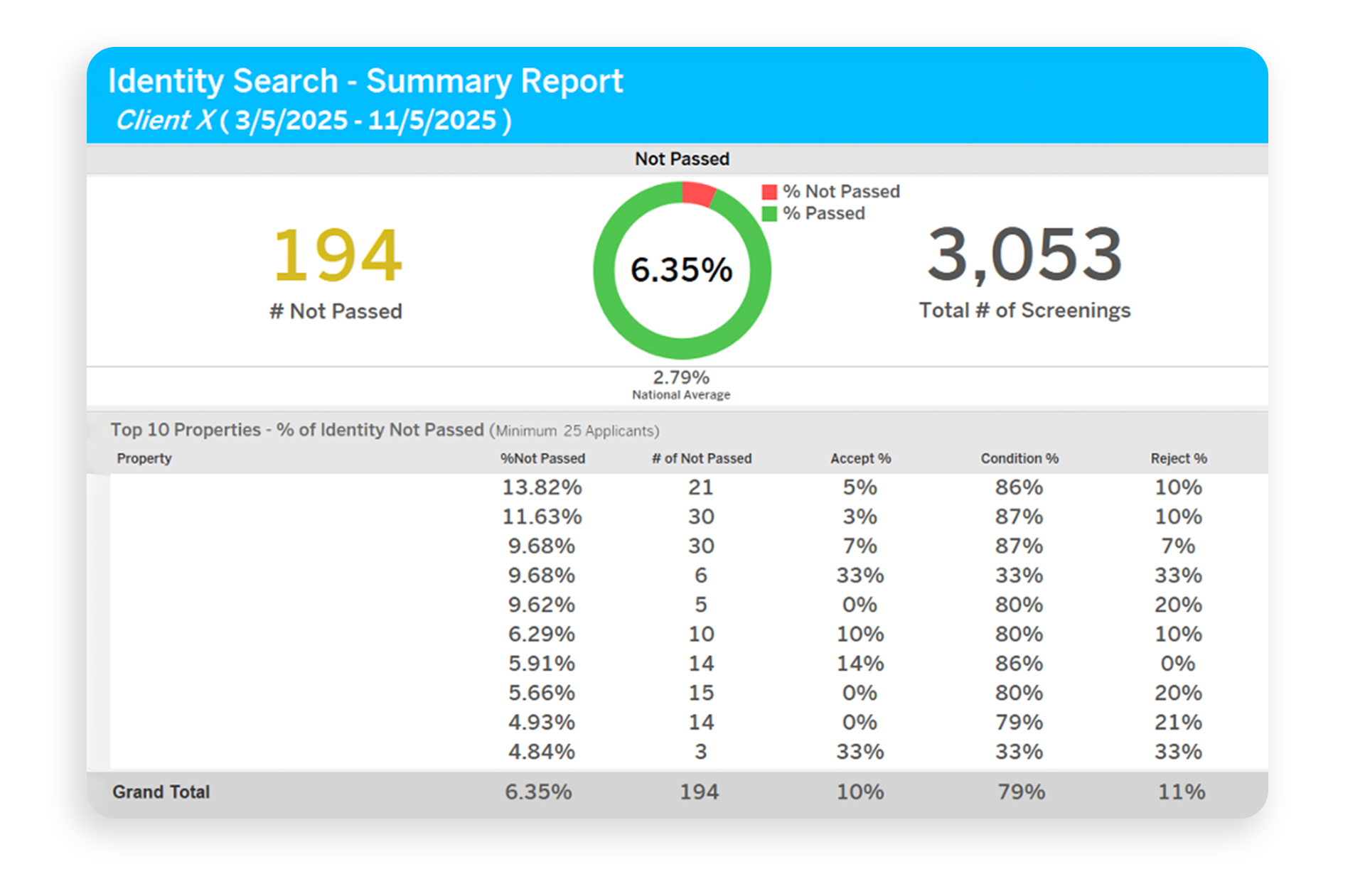

You’ll also get reporting that highlights how many applicants fail identity verification, filtered by property or across your portfolio. These insights help pinpoint where fraud is occurring and how to focus your deterrence efforts where they matter most.

Our tenant screening and fraud suite doesn’t just check credit. It uses layered identity verification and machine learning to catch synthetic identities before they become a problem. This proactive approach helps you maintain occupancy integrity and avoid costly evictions.