ResidentShield Insurance

Gain peace of mind

ResidentShield Insurance protects owner assets and provides reliable coverage with individual and Master Policy programs. Automated online enrollment built into the Voyager leasing workflow makes it simple.

Features

Offer peace of mind

Provide comprehensive resident liability and personal contents coverage at full replacement cost with a quick, easy claims process. Policies cover personal property against fire, smoke, lightning, wind, water damage and theft. No resident is denied coverage.

Achieve 100% compliance

Reach and sustain total compliance with the ResidentShield Protection Plan using automated tracking built into Yardi Voyager. Optimize risk management with comprehensive compliance reporting and automated property-level monitoring.

Simplify resident enrollment

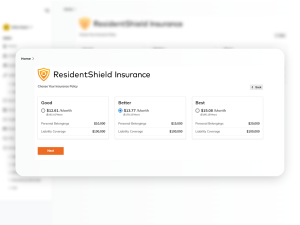

Allow residents to meet their insurance requirement before move-in with options built into the application process. Existing residents can easily switch plans or provide proof of insurance through RentCafe Living. Renters can visit our dedicated site, ResidentShield.com, to explore coverage options, calculate the right plan, file a claim and more.

Mitigate your liability

Leverage the ResidentShield Master Policy Program for a property-placed option that protects against liability claims from resident-caused damage. This option gives residents an easy, affordable way to meet insurance requirements, with the property manager listed as the primary insured and the resident as an additional insured.

Cover senior living communities

Offer your senior living residents thorough liability and personal contents coverage at a competitive price to help protect your communities from resident-caused damage. ResidentShield Insurance for Senior Living offers flexible options for industry providers and senior enrollees.

Testimonials

Easy sign up, higher adoption

Our residents can sign up through online leasing. Because of that, our participation has risen dramatically. ResidentShield Insurance has absolutely provided an avenue for us to meet our participation and adoption goals for insurance.

Easy to integrate, easy to execute

ResidentShield Insurance is easy to integrate, easy to execute and provides all the components that we were looking for in a good insurance program to implement across our entire portfolio.

100% compliance

Moving to ResidentShield Insurance has been a great experience. We rolled out an automated enrollment program with ResidentShield Insurance that brought us to 100% compliance on day one with all our properties.

Resources

Clients

FAQ

Renters purchase insurance so that liability protection is in place if they cause damage at the community or another’s personal property.

ResidentShield HO4 offers resident liability and personal contents coverage against fire, smoke, lightning, wind, water damage, and theft. The resident is the primary insured. ResidentShield Master Policy Program gives residents an easy, affordable way to fulfill an insurance requirement. It protects the property owner against liability claims resulting from resident-caused damages.

Without an insurance policy in place, residents can be held personally liable for community damage and owners can face severe financial exposure. Residents are responsible for damage to their unit as well as any damage they may cause to the property of other residents at the community, even if the damage is accidental. Mandating liability coverage is an effective means of reducing an owners’ potential out-of-pocket costs with repairs, rebuilds, and loss of income. It also offers a way for residents to replace damaged or destroyed personal property.

New and existing residents can sign up for ResidentShield Insurance during their online application or logging in the resident portal within RentCafe Living. RentCafe Living is a central location for future and current residents to move in, pay their rent online and manage their everyday essentials like insurance, electricity and internet.

ResidentShield insurance policies are backed by the most experienced underwriters in the industry. Yardi offers ResidentShield renters insurance and the ResidentShield Master Policy Program through its wholly owned subsidiary Peak Insurance Advisors, LLC, dba ResidentShield. Insurance products are sold through Peak Insurance Advisors, LLC, an independent insurance agent and wholly owned subsidiary of Yardi Systems, Inc. Peak Insurance Advisors, LLC does business in California as Premier Multifamily Insurance Services LLC, in New York as Premiere Multifamily Insurance Services, LLC, and in Michigan as Premier Multifamily Insurance Agency LLC. Insurance is provided through several third-party underwriters.

ENERGIZED FOR TOMORROW

We’re here to help

Do more with innovative Property Management Software and services for any size business, in every real estate market.