The rise of the build-to-rent sector is changing the way we live – but gaining support from local authorities is critical to its success. Now firmly established in London, Manchester, Birmingham and Leeds, the market is also taking off in Scotland – but how is this market different, and what are the challenges for investors and developers? Yardi brought together a panel of industry thought leaders to discuss the main issues. Iain Murray, managing director, LIV Consult Dan Cookson, digital innovation consultant, Homes for Scotland Christa Reekie, commercial director, Scottish Futures Trust Rick de Blaby, deputy executive chairman, Get Living London Peter Carus, associate, GVA Claer Barrett, Financial Times (chair) CB: How does the Scottish build-to-rent market differ from England’s? IM: Looking at demographics, earnings and the overall rental market, Scotland is not that different from Leeds, Manchester or other big English cities outside London. Lots and lots of people rent. The difference is that Scotland, at the moment, is behind the curve. The Independence Referendum [in 2014] created a great deal of uncertainty, which held the market back. Talk of a second referendum had the same effect. If that were to start up again, investors would begin to get nervous. For now, investors seem to have got over Brexit and the ‘indyref’ – their money has to be put somewhere. PC: The key difference is that build-to-rent is taking its time to get going in Scotland. At a national level, there’s clearly been a big push. Now that’s beginning to come down to local government level and the planning authorities are supportive of new build-to-rent projects. RdB: The further you get from London and the South East, the more open for business local authorities are. The planners in Glasgow have been very receptive, and the new planning advice note that has recently come from the Scottish government is very useful too. IM: It does help that Scotland has a majority government too. CB: How are Scottish leases different – is this a problem for investors? RdB: The Scottish residential lease is distinctly different. When a tenant leases an apartment, effectively they have indefinite security of tenure. That might put some investors off; it certainty doesn’t put Get Living off as our model seeks to accommodate longer resident commitments anyway. IM: As a build-to-rent management company, our clients want people to stay for as long as possible. Turnover in tenancies costs money. CR: The Scottish system creates a lot of certainty for tenants that simply doesn’t exist in England. IM: Scottish leases are something that will put investors off if they don’t do proper research. Some build-to-rent investors will have an endgame of eventually selling the flats they develop. And they still can. There are extensive grounds for ending a lease and evicting the tenant; reasons include that you are selling the property, it is being refurbished, they have broken the tenancy agreement, they are being anti-social. As a build-to-rent management company, we are quite keen on this legislation as it gives me additional security. But from a conceptual point of view, investors outside Scotland may find it difficult – anything different from the norm, and some investors will think it’s easier to put my money in Manchester or Birmingham. CB: How have you changed your business model for the Scottish market? RdB: There are three, possibly four, cities in Scotland where build-to-rent could work. We have bought a 7.5-acre site to the east of the Merchant City in Glasgow, and we’re about to submit a planning application for 727 private rental with 99 student units. Our model is all about scale – we don’t do under 500 units. It is tempting to take what works in London and replicate it. But our focus groups in Glasgow have provided some valuable insights. For example, renters up here in Scotland don’t do as much apartment sharing as those in...

Focus on Asia

New Real Estate Tech Era

Reliance on spreadsheets and manual processes in Asia will likely fade as investors and technology providers lay the groundwork for sweeping modernization, according to a recent survey of technology adoption in the region’s real estate industry. Yardi sponsored the survey and subsequent report on current and anticipated technology applications by real estate investment firms, developers and service providers in Asia. Chinese real estate business intelligence source Mingtiandi completed the survey and report, which describes the region’s real estate’s current technology adoption as “firmly in the PC age,” with “significant reliance on manual methods for collecting and storing data” that makes it “slow to make the jump to database-enabled online solutions that can respond to marketing, analysis and property management challenges.” While companies have some systems in place, “the majority [of respondents] still see the Asian region in general, and the real estate industry specifically, as lagging world trends.” Key findings from the survey, the majority of whose respondents work in China, Hong Kong and Singapore: More than 55% of respondents perceive Asia as trailing the West in the adoption of technology within the real estate industry; less than 12% saw the region as the leader Almost 77% regard real estate as trailing other industries in technology adoption; less than 6% regard property companies as leaders More than 83% consider access to information a competitive necessity More than 42% manage leasing, sales and property management on spreadsheets 43% identify internal resistance to change as the single largest barrier to adopting online tools for improving workflows and streamlining operations Asked to identify their priorities, more than half of respondents want better information on deal-related data. Forty-two percent listed access to leasing information and more than 35% identified better access to client contact information. ‘The results of...

Social Housing

Overcoming Tech Challenges

Peter Altobelli, vice president and general manager at Yardi Canada Ltd. and Sean Bremner, maintenance director at Baptist Housing, presented a session on Social Housing Technology to a packed room at Housing Central. The conference was held in Richmond, BC and hosted by the British Columbia Non-Profit Housing Association. During the presentation, Altobelli and Bremner explored how technology can improve organizational management and generate cost savings with high returns on investment. The presentation also gave attendees advice in preparation for change as they implement new technology. As vice president of a software provider that works with social housing organizations across Canada, Altobelli provided insight into the latest technology geared for non-profit housing managers. “The crucial value-adds that an organization will realize with the use of technology are automating tasks, improving the user experience with better tools to increase productivity, and simplifying staff management,” said Altobelli. Altobelli spoke about how automated processes are most effective when based in the cloud and optimized for multiple web browsers, including tablets and smartphones. Putting those solutions in the cloud makes it easier to create effective access for tenants and prospects, property and financial management and maintenance management. “When you are able to access accounting, budgeting, inspections, maintenance, energy and resident management data all on one system, it enables increased productivity for your entire team,” Altobelli said. Bremner presented a case study of how his organization, Baptist Housing, overcame internal challenges with technology. Focusing on maintenance workflows, Bremner described how former processes that required manual, handwritten notes often omitted relevant details, made it difficult to access active maintenance requests, created scheduling challenges and limited the capability of Baptist Housing to report on current and past maintenance requests. “We adopted a cloud-based software solution that drastically changed our maintenance program....

Managing Disruption

Insights from Yardi Canada

The spotlight shone on Yardi Canada for much of late November and early December at major industry events in Toronto. The company was the closing roundtable sponsor at the Global Property Market Real Estate Forum and sponsored the Toronto Real Estate Forum’s keynote session. Yardi Canada was also the top-level Title Sponsor and staffed a booth at PM Expo, the property managers’ exposition portion of The Buildings Show, Canada’s largest event for the design, architecture, construction and real estate communities. Yardi was also the Platinum Sponsor for the Federation of Rental-housing Providers of Ontario (FRPO) 2017 MAC Awards gala, a dinner and awards show that recognized excellence in rental housing advertising, construction and renovations, environmental excellence, customer service and other categories. Peter Altobelli, vice president of sales and general manager for Yardi Canada, presented at PM Expo’s “Disruptive or Transformational Technology: Understanding the Impacts for Property Managers and Owners” session. Peter began the session by clarifying that disruption may be defined as an outside force that mobilizes technology transformation within an organization. We have seen these types of disruption in the way we access and use data analytics to inform business decisions and the way in which we store information in the cloud. An organization’s ability to transform through technology is the key force in maintaining their competitive stance in the market. “It’s all about changing a mindset and using advanced technology that can perform various business operations in new ways,” he said. “Disruptive automation technologies can give property managers new insight into leasing, energy management and other operations that improves decision-making.” Yardi Canada was active in another session at PM Expo as Martin Levkus, regional director for Yardi Energy, Sales, moderated a discussion among three building energy management experts in the “Energy Data...

Green Lease Leaders

Energy Best Practices

Commercial building owners, tenants and brokers need the right tools to incorporate energy efficiency into leases. A program called Green Lease Leaders stands ready to provide them. Green Lease Leaders helps real estate practitioners create leases that promote collaboration on investments such as high-efficiency rooftop air handling units, lighting retrofits, water irrigation upgrades and solar panels. The program was the subject of a recent webinar, “How to Become a Green Lease Leader: The Latest in High-Performance Leasing Practices and Recognition.” Presenters included Holly Carr, a Department of Energy technology program specialist, Sara Neff, senior vice president of sustainability for Yardi client Kilroy Realty Corporation, and Alexandra Harry, program manager, market engagement for the Institute for Market Transformation (IMT). Green Lease Leaders was developed in 2014 by IMT, a Washington, D.C. nonprofit and the webinar’s host, with support from the Energy Department’s Better Buildings Alliance. IMT works to unlock building energy efficiency that it says could save the U.S. office market $3.3 billion annually and cut energy consumption by 22% in leased buildings. The program currently includes landlords, tenants and brokers who represent 1.3 billion square feet of commercial, industrial and retail space. “Tenants and landlords share an obligation to understand how much energy their buildings use and jointly share the cost of upgrades as well as the resulting maintenance savings and best practices,” Carr said. “Benefits of green leasing include reducing utility bills by up to 51 cents per square foot, increased net operating income, reduced occupancy costs, increased occupant satisfaction, fewer greenhouse gas emissions and improved landlord-tenant communication and relationships.” Along with defining new best practices for energy efficiency in buildings, the program also offers participants technical support, peer networking opportunities, tools for comparing current leases to Green Lease Leaders standards and other...

Build to Rent

Responding to Proptech

LONDON – Technology has changed all our lives so fundamentally in recent years that it is sometimes difficult to look back to an era when things were done differently. Today’s normality was, just a short time ago, unthinkable. Banking is a good example. Today, we take it for granted that we can access our accounts at any time and transfer money and pay bills quickly and cheaply. The chequebook is still available for those who need it, but it won’t be long before they too are consigned to history. Then take taxis. While in London at least, using a cab was once the preserve of those with substantial salaries – or travelling at somebody else’s expense – now the rise of Uber and others means that getting a ride home is a real option for many people. Property has, of course, been slow to embrace the benefits that digital technology can bring – one estimate is that the industry is around 20 years behind financial services – but that is starting to change and at pace. Just a few years ago, if the property press mentioned technology at all, it was to reference the influence of the likes of Rightmove or Zoopla. Today the phenomenon has its own name: proptech. A lot of attention has been paid to how proptech is disrupting the industry, most notably through big data potentially making the role played by many agents redundant. That is obviously a cause for concern and the introduction of new ways of working will obviously have to be done with care and compassion. But proptech also has the potential to bring huge benefits to both property companies and their consumers – and without the need for anyone to lose their jobs. In no sector...

Smooth Sailing

Property Congress Recap

Yardi celebrated the 40th anniversary of Property Council of Australia’s “Property Congress,” a premier event for the Australian real estate industry. Yardi held its accustomed place as Principal Sponsor of the event, which took place in Cairns, Queensland. Several senior members of the Yardi Australia team attended, including Mark Heaney (project manager), Kelvin Manual (regional manager), Nina Feldman (marketing manager), and Terry Gowan (regional director for Australia and New Zealand). Kicking off the event with some fun, Yardi hosted the nautically themed “Welcome Aboard” party on the conference’s first night, welcoming more than 700 industry thought leaders, trendsetters and other experts from all property sectors. Yardi also sponsored a coffee station at the event, keeping delegates and speakers energised. With thought leaders from a broad cross section of the industry presenting, sessions at The Property Congress included: A “View from the Top,” a panel of real estate leaders David Harrison of Charter Hall, Louise Mason of AMP Capital, Steve Leigh of QIC Global Real Estate, Greg Paramor of Folekstone and Caroly Viney of Vicinity Centres. They reported a positive outlook for the retail, commercial and residential sectors, which show strong growth trends despite fears of competition from online retailers. Their message was one of confidence for the year ahead and the real estate landscape in Australia. “Cities for Everyone,” which examined how data from social media, online retail apps and other sources can be used to shape the activities, and therefore the character, of a city. Describing how important live, ongoing information is to creating “Cities for Everyone” for those who work and live in cities, the session provided a fascinating insight into how data can directly shape cities and lives. A presentation by Peta Credlin, Sky News host and News Corp national columnist,...

Retail Management

Keys to a Successful Portfolio

As modern landlords strive to drive footfall and revenues in their shopping centers, they are using sophisticated new tools and techniques. Astute use of data can lead to better-informed decisions – but how is the impact of this new discipline being felt across the property industry? Yardi brought together a panel of thought leaders in the sector in a round table event in central London. Fiona Hamilton, global head of retail for international brands, BNP Paribas Allan Lockhart, property director, NewRiver REIT Charles Maudsley, executive director, head of retail, British Land Sophie Ross, group head of multichannel, Hammerson Ailish Christian-West, head of portfolio, shopping centers, Landsec Claer Barrett, personal finance editor, Financial Times (chair) How widespread is the use of data becoming within physical retail assets? SR: It’s relatively easy to capture data – it’s much harder to add value. I would say that only around 20 percent of the data gathered by landlords is being used effectively. CM: Data is just the starting point. At British Land we collect and analyze more data than ever before about shopping patterns, demographics and spending. We replay that to retailers. Anonymised mobile phone signals can show us a heat map of where shoppers are in the center, and point to linkages between retailers. For example, our brand profiling shows TK Maxx and Pret a Manger are highly correlated. TK Maxx in Hinckley – would an adjoining Pret boost their sales? We can measure conversion rates – the number of people who pass a store versus the number who actually go in. We can say to a retailer, it’s 30 percent in your shop, but it’s 90 percent elsewhere, so let’s find out why. We can show retailers looking to open a store with us how their...

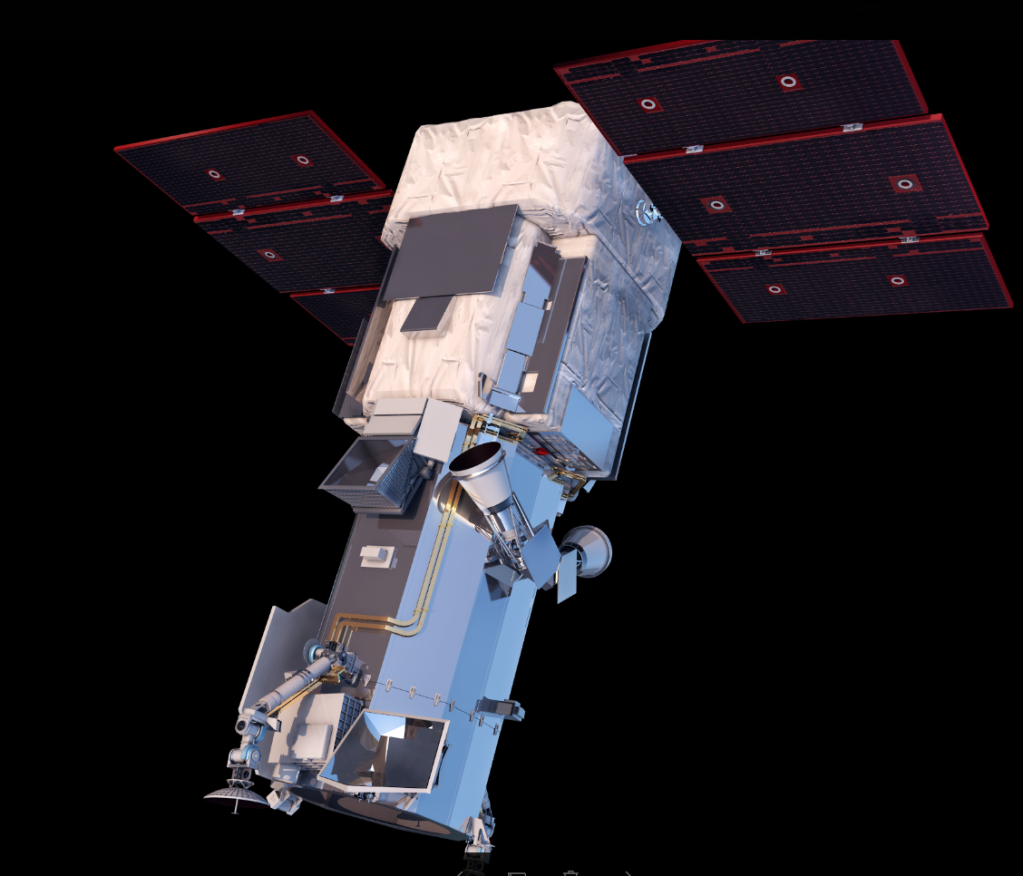

Recon from Space

Satellites + Real Estate

Earth-orbiting satellites have been part of the fabric of daily life for more than 50 years. Billions of people depend on them to support fast, accurate execution of communication, weather monitoring, military and intelligence operations, and other activities. In recent years, the property management industry has become a leader in leveraging space systems’ elevated perspective for better-informed decision-making. Sharp Images from Orbit A key connection between satellites and real estate stakeholders is Westminster, Colo.-based DigitalGlobe, owner and operator of five imaging satellites launched between 2007 and 2016. (Two other satellites launched in 1999 and 2001 were decommissioned, although their imagery remains available.) Equipped with best-in-class optics and electronics, the satellites—GeoEye-1 and four WorldView-class sensors—crisscross the globe, snapping high-quality pictures from low Earth orbit (300 to 478 miles). Imagery from DigitalGlobe’s satellite constellation, which is capable of covering more than 620 million square miles annually, populates GBDX, a big data digital library and analytics platform. Investors, insurance companies, environmental managers, urban planners and others involved in buying, developing and occupying properties tap into GBDX. The high-resolution (about 12 inches) imagery aids site selection and development planning, property value and insurance assessments, solar and wind energy potential, code enforcement and more. The collection, transmission, processing and dissemination cycle can take as little as two hours, and the data can be used to create 3-D, stereo and digital elevation models. Assessing Risk “If you’re thinking of purchasing property for investment or development, there’s a lot you need to know: what’s a building’s size, shape, configuration and proximity to neighbors? Is a property flooded, burned or otherwise damaged? What’s the possibility of fire, floods, wind or hail? What is the best access route for emergency service providers? Are there new additions or deletions that could impact value or...

Renters Speak Out

Canadian Tenant Survey

If you’re currently a renter or have ever been one, you’ve probably wondered whether or not your landlord considers your needs for a happier home. A recent survey of thousands of Canadian renters sent a clear message to property managers everywhere: from soundproof walls to high speed internet and online services, renters are expecting more from their apartment living experience. And perhaps not surprisingly, technology tops the list. Sponsored by Yardi, results of this year’s Tenants Preference Survey, the only survey of its kind for the Canadian market, were presented at the Canadian Apartment Investment Conference (CAIC) on September 6, 2017. The CAIC brings together property owners, managers, investors and developers to provide valuable insights into the residential real estate market including how to increase net values. This year, attendees were eager to hear about what renters really want and how to keep them happy. Birth of the Project According to Sarah Segal, director at Informa, the survey was inspired five years ago by a real estate roundtable discussion that raised questions about what renters wanted. Informa delivers over 150 trade and consumer exhibitions annually across the globe including the Canadian Apartment Investment Conference, and engages industry leaders to understand key trends and concerns impacting property owners and managers. With more digital tools to empower its research in 2016, Informa partnered with Rentlogic and worked with founder Yale Fox and Amy Erixon from Avison Young to conduct a small survey of 2,000 renters. Segal said the survey produced some interesting findings, but Informa wanted wider distribution and more targeted questions for the next survey. To accomplish that, the company sought industry support including sponsors and the participation of property managers. Segal commented, “Yardi was immediately onboard with helping us produce an in-depth renter survey and...

Multifamily Outlook

Smooth and Steady

Yardi Matrix reports another strong summer for the multifamily real estate sector. The fundamentals were downgraded from “great” to “consistently good” but several factors suggest continued, healthy performance. Even rapid development in some of the nation’s hottest markets has slowed to a more sustainable pace due to construction labor shortages. The shortages may have longer-lasting effects due to disaster recovery efforts throughout the United States. Rents For the last year-and-a-half, rent growth as gently declined as rents inched upward. The rent growth deceleration may be drawing to an end, though, as the supply boom reaches it apex. National average rents increased by 2.4% on a year-over-year basis in August, yet are down from 4.6% at this time last year. Deliveries are not manifesting as quickly as previously anticipated, which should moderate rent increases. The long-term outlook for multifamily seems promising due to favorable fundamentals and demographic trends: Millennials are forming households, wage growth remains solid, and the economy is relatively healthy. Hottest Markets The hottest metros for rent growth are still secondary markets that are lagging on supply. Tacoma (8.1 percent), Sacramento (7.7 percent), Colorado Springs (7.6 percent) and the Inland Empire (4.3 percent) are four of the fastest growing markets yet they’re only estimated to increase stock by 1 percent this year. These markets benefit from their proximity to larger markets such as Seattle, the Bay Area, Denver and Southern California. They enjoy vigorous employment growth and popularity with Millennials. The young renters look forward to the areas’ desirable lifestyles with lower costs. There are always exceptions. Seattle faced 5.9 percent rent growth regardless of the surge in supply. Analysts are exploring the connection between rents and the city’s increased minimum wage. Minimum wage increased from $9.47 in 2015 to $13. Nashville is...

RFD Social

Ponce City Market Tower

An eye-catching yet awkward space may soon become Atlanta’s hottest new bar and lounge. The site of Ponce City Market was once home to Sears, Roebuck & Co. headquarters. When it opened in 1926, newspapers heralded the 2.1 million square-foot building as the largest brick structure in the southeastern United States for decades. It remained in operation until 1987. In 2012, the site reopened as a mixed-use hot spot for Atlanta locals and tourists alike. Nearly 85 businesses call Ponce City Market home. Restaurants, clothiers, bars, and artisanal shops share a space the buzzes with energy and young, hip shoppers. Though Ponce City Market has enjoyed success, its iconic tower remained desolate. Shops and restaurants occupied lower levels of the structure but the unique vision for floors 10, 10.5, 11, and 12 lingered unfulfilled. What Now Atlanta reports that operator Slater Hospitality has finally found a suitable use for the challenging 16,172 square-foot space. Plans for RFD Social are in the works. Rumor has it that RFD Social is short for Dinner Bell Radio Farmers’ Democracy, a radio show that once broadcast from the Atlanta Sears Tower in the 1920s. Kevin Slater, owner at Slater Hospitality, has not confirmed or denied this claim. RFD Social will include a multi-level bar and lounge, as well as an events space with a catering kitchen. Adjoining businesses include Skyline Park, Nine Mile Station restaurant, and Rooftop Terrace events space. While locals are excited to see the space put to good use, a few questions remain unanswered since the press release issued in late August. “I want to know if it will be a public space or if it will only be for private events,” said Kimmey Elliot, 26, an Old Fourth Ward resident. “We don’t need another...

Recovery from Harvey

Aid Heads to Texas

In the wake of Hurricane Harvey, Congress has approved a $15.25 billion disaster aid package for the Federal Emergency Management Agency (FEMA). An additional package for Hurricane Irma recovery is likely under deliberation. The approved funds will contribute to, yet not cover, emergency assistance for regions of Texas and Louisiana overcome by Hurricane Harvey. The total funds needed for recovery may exceed $50 billion, according to analysts. The Gulf Coast of Texas received an unprecedented 50 inches of rain in less than four days. Homeland Security reports the loss of at least 70 lives and the destruction of more than 100,000 homes. Nearly 42 percent of Texans live in areas covered by the disaster proclamation. Beyond the Storm After Hurricane Allison, the 2014 City of Houston drainage study revealed that many of Houston’s poorest communities were inadequately prepared for “even modest storm events.” The National Community Reinvestment Coalition published a statement and map that shows the correlation between high-risk flood zones and communities of color. CNN reports that the city council approved $10 million to reduce drainage issues. Texas Housers and the Texas Organization Project claim that the City of Houston did not take action to protect its residents or mitigate the effects of Hurricane Harvey. Dam releases contributed to the devastation. On Monday, the US Army Corps of Engineers began to release water from the Addicks and Barker dams. The assumption was that the neighborhoods could better manage the water with controlled releases than uncontrolled overflow from the dams. Flood control officials in Harris County estimate that hundreds of properties flooded as a result of the controlled releases. Seeking Shelter Housing is the leading priority for disaster recovery specialists. Red Cross and partner associations opened 240 shelters in Texas and six shelters in Louisiana....

Helping After Irma

Yardi Offers Assistance

When Hurricane Irma devastated a string of Caribbean islands and loomed off the coast of Florida, it had been less than two weeks since Hurricane Harvey made landfall in southeast Texas, displacing thousands of people from their homes. Irma was the strongest Atlantic basin hurricane ever recorded. It triggered evacuation orders for 5.6 million people and made two landfalls before being downgraded to a tropical storm on Monday, September 11. For a second time this summer, our team members mobilized for a natural disaster response. Having recently created a housing website to help those affected by Harvey find temporary and permanent homes, we used this experience to quickly launch another dedicated housing registry to assist residents displaced by Irma. Leveraging our RENTCafé property marketing and leasing platform, RentCafe.com/HurricaneIrma allows displaced residents to find new housing. It also makes it possible for housing providers with properties in the affected and surrounding areas to quickly and easily list available units, some with special concessions. There is no charge for companies to list their properties on the website or for residents to use it. There is also a toll-free hotline that evacuees can call seeking housing assistance if internet is not available. The hotline can be reached at (844) 363-6317. With many clients in the affected areas, we’re offering disaster response assistance for clients affected by either hurricane, including additional program support and tools to help clients communicate with their residents during the aftermath. Taking care of our clients is a critical part of the Yardi mission statement, and representatives are reaching out now to offer these and other services at no charge. “The best-case scenario for everyone is that our disaster response efforts remain untested, but we have them in place so that we can aid...

Up to Bat

Cricket Expands in US

Pennsylvania-based Global Sports Ventures plans to introduce eight professional cricket teams to the United States. Each team will have its own stadium complex as part of a three-year initiative to solidify the sport’s presence in the country. To Jay Pandya, chairman of Global Sports Ventures, the U.S. is the next natural frontier for cricket. The sport has a growing and passionate fan base. More than 1 million viewers watched the live broadcast of the 2015 World Cup. That same year, an exhibition series touring Los Angeles, Houston, and New York attracted audiences averaging 28,000 viewers. “We, as Americans, look for new things and grow into different fields. People don’t realize that cricket was partially born in the U.S. The first international game was played between the U.S. and Canada in New York. The 1844 game, played in Bloomingdale Park in Manhattan was one of the earliest international games on record,” Pandya explains in an interview. Possible stadium sites include Atlanta, New York, San Francisco, Chicago, Dallas, Orlando, Washington, D.C. and East Brunswick, New Jersey. These markets were chosen, in part, for their large Asian populations according to an article on Bisnow.com. “When you have people of South Asian descent who really understand cricket, it helps. But after that it will probably go mainstream with Americans. I believe that will be very quick, because, as Americans, we just love sports. [And] it doesn’t matter what kind of sport,” says Pandya. To jump start the plan, Global Sports Ventures entered a $70 million licensing agreement with the USA Cricket Association (USCA). More than 32,000 cricket players are registered with the USCA and may become members of the future teams. There are also several smaller organizations throughout the nation that may serve as sources of talent and...

Facebook Live

5 Tips to Rock Live Video

Video continues to rise to the top of the digital marketing playbook. If you’re skeptical about the power of video, consider that almost 50% of internet users look for videos related to a product or service before visiting a store. And four times as many customers would rather watch a video about a product than read about it. Video content can also improve SEO, increase engagement and boost brand loyalty and awareness. Within the realm of real estate, the industry – from retail to residential to student housing – is finding creative ways to leverage video. What’s clear is video isn’t going anywhere, so it’s time to jump in feet first. Facebook Live offers an interactive, free and highly visible way to engage with an audience. The platform now sees 8 billion average daily video views from 500 million users. With help from social media experts, in-depth tutorials and best practice tips, even the most novice user can become a Facebook Live pro. Here are five tips to rock Facebook Live: Step 1: Ask permission If you plan to live stream other people, ask for permission before you record them. Keep in mind some conferences and venues may have strict no streaming policies. When in doubt, ask. Step 2: Game plan Some questions to inform your live video strategy: Why do you want to do live video? Who are you hoping to reach? What do you want this audience to do? What will you talk about? How long will you go live for? Facebook recommends 10 to 90 minutes, but even 5 minutes is great. Do what feels right for your organization and your viewers. Where will you go live from? Walk the room and consider reserving a spot in front. Minimal background...

Canada in Focus

Retaining condo corporations

If you are a condominium property manager, every day you work towards maintaining your properties to make them desirable places to live, while keeping operations running smoothly. Further, you must ensure the properties meet the expectations of owners and condo corporations. In competitive markets such as Toronto and Vancouver, this is especially key. According to the experts, the lack of single-family residential unit supply in the current Canadian market is expected to create opportunities for condo markets to absorb excess demand. Condo demand is forecast to increase in Toronto and Vancouver, due to factors including urban migration and the interest of foreign real estate investors. In addition, rising house prices, which have reached 4.6 times the national average household income, further powers the condo market. Given the high demand and potential growth in this industry, it is crucial to stand out as a property manager. Following are some tips to help you attract and retain condo corporations and at the same time reduce your overhead costs and streamline your operations. Enhance Your Digital Presence It all starts with branding. In today’s world, it is imperative to have a digital presence in order to establish credibility of your business and to attract prospective customers. When it comes to your property management brand, curb appeal matters. Critical first impressions often happen online. Creating a beautiful property website with rich, easy-to-use features including an owner portal will further heighten your brand value and make you a more valued property management service provider. Creating a Community Due to the growth in demand in the condo property market, creating, promoting and maintaining a strong sense of community is crucial to stand out as a property manager. Of course, property appeal goes beyond landscaping and renovations. Today’s owners are looking...

Every Watt Counts

Benchmarking in the Big Apple

On December 28, 2009, New York City Mayor Michael Bloomberg signed Local Law 84 (LL84), mandating annual energy reports for any privately owned buildings over 50,000 square feet. (In October 2016, the city expanded LL84 and LL88 to include buildings 25,000 Sq. Ft. and higher, though, this doesn’t officially go into effect until 2018.) Enacted as part of the city’s Greener, Greater Buildings Plan (GGBP), LL84 was designed to help building owners not just measure energy use, but to develop actionable energy efficiency strategies based on that data. By the time the first benchmarking report was released in 2012, the city had gathered energy usage information from 1.8 million square feet of commercial and residential space, making it one of the largest accumulations of benchmarking data gathered for a single jurisdiction. “Buildings account for 75 percent of all greenhouse gas emissions in New York City, yet many property owners and managers do not know they [can] be a part of the solution and save money by making their buildings more energy efficient,” said Mayor Bloomberg in a statement after the first benchmarking reports were released in 2012. “This benchmarking report will help us understand where we can act most quickly to significantly reduce GHG emissions and achieve our PlaNYC goals.” Lights, Meters, Action Often considered the low-hanging fruit of energy efficiency implementation, improving a building’s lighting system can dramatically reduce energy consumption. In New York City, roughly 18% of energy use in non-residential buildings can be attributed to lighting, which also accounts for 18% of the city’s carbon emissions. With the goal of reducing greenhouse gas emissions by 30% within the next 15 years, Local Law 88 (LL88) was designed to address the need to encourage lighting upgrades for improved energy efficiency and reduced...

NewRiver REIT

UK client interview

The British retail investment market joins the rest of the United Kingdom’s business community in facing a host of unknowns in 2017. Chief among them is the timing and impact of the UK’s exit from the European Union following the outcome of the referendum in June 2016. Yardi caught up with one its partners, NewRiver REIT, a specialist retail and leisure investor, asset manager and developer whose convenience-led positioning means it is uniquely placed to navigate these uncertain times. NewRiver’s £1.3 billion portfolio includes 33 community shopping centres, 22 retail parks, 16 high street assets and 350 pubs. The portfolio provides consumers up and down the UK with its daily essentials – those items essential to daily life, the things consumers require, opposed to what they simply desire. Fundamental to the success of the business over the past seven and half years has been how NewRiver has engaged with and satisfied all the stakeholders within its chain, from store customers, retailers, peers, advisors and local authorities all the way to its institutional investors and shareholders. “At the heart of the retail sector is the customer and our business begins with building and retaining consumer loyalty,” says Emma Mackenzie, a Director at NewRiver who manages assets in Scotland, Northern Ireland and the north-east of England. “At the local level, we make sure our shopping centres satisfy the needs of the towns they serve. Its about providing a variety of products and services at a price the customer can afford. Furthermore, we work hard to ensure the environment is fit for purpose – and that includes such basic factors as the centre being clean and accessible as well as bright and attractive and providing somewhere to sit down or get a cup of tea.” Brexit has triggered...

Top Office Deals

2016 Transaction Recap

The U.S. commercial real estate market took something of a respite in 2016, during a year characterized by political volatility. Compared to the previous year, when the market fired on all cylinders, office players were more cautious in 2016, with leasing and sales activity cooling down to more sustainable levels, per most industry reports. Office tenants were reluctant to make any major moves pending the conclusion of the presidential election, thus lease renewals and consolidations took the stage in the past year. Though office sales activity also decreased 7% year-over-year, according to Colliers, the national transaction volume was still the fourth-highest yearly total in the past 15 years, reaching $140.5 billion. We enlisted the help of Yardi Matrix sales data to round up a list of the 50 largest office deals of 2016. The results of our analysis aren’t all that surprising: the New York City office investment market remains the most attractive destination for both local and offshore buyers, though other markets also landed a good deal of capital in the past year. The U.S. office market is poised to become even more attractive in the future, especially to foreign investors, if Brexit goes through. Check out the list of the top 50 largest office deals of 2016 on the CommercialCafe blog. NYC Home to Largest Single-Asset Sale of the Year The priciest office transaction in New York City and the second-largest overall office deal of the year was the $1.93 billion sale of the AXA Equitable Center at 787 Seventh Avenue in Manhattan. One of the biggest investments in pension fund CalPERS’ history, the sale closed Jan. 27, 2016, at $1,179 per square foot. The 51-story, 1.6 million-square-foot tower is LEED certified and includes 49,000 square feet of retail space, a parking garage and access to the underground concourse of Rockefeller Center. CalPERS bought the...

Tallest Passive House...

Cornell Tech Tower

New York will soon boast the world’s tallest passive house building. Cornell Tech tower will break international records and set a new standard sustainable building. Cornell Tech residential tower is a collaboration between Yardi client Related Companies, Hudson Companies, and Cornell Univerty. The residential high-rise broke ground in 2015. Upon completion this fall, it will stand 26 stories high and cover 270,000 square feet. It houses 356 rentals with floor plans ranging from studios to three-bedroom suites. Amenities include a rooftop deck with city views, a lounge, gym, and bike room. To promote an atmosphere of learning, the site hosts numerous public spaces. These tech-ready meeting rooms encourage interaction between faculty and students. The residential towers provide easy access to the East River tram and metropolitan subway. Both connect to Manhattan and its transit hubs. Cornell Tech residential tower will be the tallest Passive House building in the world. The Passive House, or passivhaus, design concept originated in Germany. It is a performance-based standard without dictated methods of construction. Passive cooling techniques such as strategic shading, air circulation and ventilation techniques keep buildings comfortable in warm weather. In cool weather, the buildings make efficient use of the sun, insulation, internal heat sources and heat recovery. Passive House buildings rely less (or none at all) on conventional heating and cooling systems. Internationally, Passive House designs can operate using 60-90% less energy than conventional buildings. “In thinking through the right type of building for a campus that honors innovation, one of the first things we came up with was Passive House construction, which could be a game-changer for the residential industry,” says David Kramer, a principal at Hudson Companies during an interview with Planning Report. It was after touring several large Passive House projects in Vienna...

Build-to-Rent

UK Real Estate Evolves

GREAT BRITAIN (March, 2017) – It is no longer about landlords; today’s property managers recognise that happy residents are at the heart of any successful scheme. Yardi invited a panel of experts in Leeds – a ‘northern powerhouse’ city heavily invested in cutting edge build-to-rent development – to discuss the rapidly-evolving sector Graham Bates – Founder and chief executive – LIV Group Jonathan Pitt – National director, corporate PRS and build-to-rent, Countrywide Joanne Pollard – Director – Five Nine Living, Fresh Student Living Andrew Wells – Partner and non-executive chairman – Allsop Letting & Management (Interviewer) Claer Barrett – Personal finance editor – Financial Times (chair) What is the biggest challenge for the build-to-rent sector? Joanne: There are three main challenges. Firstly, there’s not enough stock. Everyone wants to pile in from an investment perspective – and if you want to buy assets producing rents, that’s a challenge. Secondly, we’re all learning about this together. There are new practices and we need to find the best ones. And finally, costs. How much of a premium are people prepared to pay? Jonathan: I agree – the big challenge is where the private rented sector (PRS) sits in the market. What is the premium people will pay to live in a well-run building with amenities? And what about mid-market level? Graham: PRS is not the right label. What we do is build-to-rent. The private rented sector as a whole includes buy-to-let. We are a segment of PRS but what makes us different is that we are building for long-term rental. We are starting to see what I call ‘live learning’. As this sector started to take off, people talked about what might happen. Now we’ve got people living in buildings. We have data. We can conduct...

Affordable Cities

Top 5 Options in 2017

Where are the most affordable places to live in the U.S.? Demographia’s 13th Annual Affordability Survey brought to light a list of affordable markets in the U.S. based on their median multiple, a number obtained by dividing the median house price by the median household income. The Median Multiple is widely used for evaluating urban markets and has been recommended by the World Bank and the United Nations. According to the survey, there are 82 affordable housing markets in the country. Racine, Wisc., is the most affordable of them this year, followed by Bay City, Mich. Decatur, Ill., Elmira, N.Y., and East Stroudsburg, Pa. America’s Kringle Capital is No. 1 With a population of less than 80,000, Racine is officially the most affordable city to live in based on median house price and median household income. If you decide to settle here, you’ll be 22 miles south of Milwaukee and 77 miles north of Chicago. Located at the mouth of the Root River, on the shore of Lake Michigan, the city is most famous for its Danish pastries. In fact, its nickname is derived from the kringle, an oval-shaped, buttery, flaky delicacy. But Racine is more than finger-licking desserts. The city boasts a zoo, a beautiful lakefront, a picturesque lighthouse, museums and historic architecture. Affordability Perks Bay City, Mich., ranks second in the top 5 most affordable cities. According to recent data published by mlive.com, the city is oversupplied, which keeps home prices and rent levels very low. City officials are struggling to eliminate blight, increase home values and attract new homebuyers. So if you’re thinking about moving to a riverfront property in a quiet town, now’s the time to do it. The third most affordable city in the U.S. this year is Decatur,...

Our Greatest Hits

Yardi Blog Celebrates 5 Years

Happy birthday to us! Though it seems like just yesterday when we were brainstorming ideas for our first blog posts, The Balance Sheet celebrated its fifth birthday this month. Time flies when you’re creating great content. It is a great joy to be able to produce interesting real estate related posts for you week after week. In five years, we’ve published more than 1,400 articles by more than 50 contributors, touching every section of the real estate world – from people living in some of its tiniest apartments to the company supplying technology for property managers worldwide. Of course, we’re talking about Yardi, the inspiring homegrown company that powers this blog and much of the North American real estate rental market. We’re proud to tell the stories of the clients and employees who make up the broad and diverse Yardi universe. Take a quick trip down memory lane with us as we revisit some of the all time most popular posts on the Yardi corporate blog. Easy Yardi Training When our eLearning product launched in 2013, it quickly became popular with clients. Senior writer Joel Nelson spoke with Yardi client Simpson Housing to learn how the new platform revolutionized training on Yardi’s software offerings and much more. Four years later, eLearning is more robust than ever and offering even more advanced functionality. 5000 Strong Just last summer, Yardi marked a major milestone – hiring our 5000th employee! It was an exciting moment for the entire company and was celebrated at all of our offices around the world. We were excited to mark the occasion with a special blog post and incorporate photos from dozens of the office celebrations. Yardi Voyager 7S The much-anticipated launch of Yardi Voyager 7S was another milestone moment for Yardi....

Smarter than Ever

Yardi Business Intelligence

By consolidating portfolio-wide data and automating reporting, Yardi Orion Business Intelligence makes life a lot easier for property managers and executive decision makers. Instead of manually compiling spreadsheets that can be difficult to analyze, Orion users can instantly view a single dashboard with comprehensive performance data on their desktop or mobile device. Now, with updates made available in V10, there are more advanced tools, enhanced features and simplified ways to get the powerful data you need, precisely when you need it, wherever you happen to be. Lisa Kolb, consulting systems analyst at A.J. Dwoskin, summed up the efficiency of Orion, “People get stuck in ‘analysis paralysis’ when they review too many reports. With Orion, we’ve cleaned up the dashboard and focus on our KPIs on a screen with drilldown capabilities — instead of sending out a bunch of reports. It’s been well accepted in our organization from day one.” Here are some highlights of what’s new in Orion: Tiles: For both administrators and users, tiles have been completely redesigned to display more information. Along with the primary measure selected, now tiles can show up to four additional measures, with KPIs and optional trend comparisons. You can also control and link timeframes to the dashboard filter. With a new customization capability, you can add subcategories to your tiles. Widgets: A simplified widget toolbar features icons for each option. Enhanced widgets now allow you to filter through specific KPIs and manage by exception. New grid widget functionality includes a reference point to date controls, and allows you to view up to 50 rows per page. Newly added widgets show KPIs for multiple measures. KPIs: KPIs have evolved as well, and can now vary by just about any attribute you select including property, regional manager and metropolitan...