Here’s a sampling of developments to follow this year. Proptech grows . . . The use of property technology will continue to expand across all real estate sectors. “Property managers and asset managers are leaning into technical solutions for productivity enhancements and operational efficiency. They are digitizing as much information as possible, so that analytics can be applied and data shared throughout the organization,” says Emerging Trends in Real Estate 2020, the 41st annual forecast report compiled by PwC and the Urban Land Institute. “Using analytics to enhance customer experiences will define winners and losers in the coming years.” Much of the multibillion-dollar global investment in proptech “revolves around smart-home and smart-building applications aimed at energy efficiency” and enhances coworking and co-living concepts, the report says. Sensors activated by motion, voice, temperature or weight “are now part of the landscape, and will become more ubiquitous over time.” . . . and so does ESG Emerging Trends also addresses the growing importance of environmental, social and governance principles to real estate customers, employees, shareholders and communities. “Sustainability evaluation is becoming a checklist item for institutional investors domestically and worldwide” in real estate and other business sectors,” the report says. And with 55% of millennials, 25% of Generation Xers and 11% of baby boomers saying they factor ESG policies and performance into their investment decisions, “the power of ESG to influence capital deployment will be rising over time.” “ESG attracts a more diverse set of investors, aids in recruiting talent and helps generate community support for proposed projects,” notes an unidentified REIT executive and Emerging Trends contributor. Another REIT exec adds, “As ESG data is becoming more widely available, we’re seeing clearer ties between ESG and overall performance.” Along with comprising a standard for due...

Connection vs. Safety...

Real Estate Challenges FCC

To remain competitive, real estate providers face pressure to provide high speed internet. This pressure is felt throughout all property classes, from subsidized to luxury housing and commercial properties. Yet the Federal Communication Commission (FCC) is pushing back against signal boosters that pose a threat to public safety. The story is currently unfolding. Here is what we know: What is DAS? Broadband signal boosters are proving to be a benefit for multi-tenant real estate owners and a danger to FCC operations. Distributed Antenna Systems (DAS) are one of the most common boosters. They are a network of separated antenna nodes connected to a single source that enhances wireless service within a geographic area or structure. DAS helps to provide high-speed internet in areas where infrastructure is unfavorable for any number of reasons. Such fixed wireless technology has relatively little capital expenditure for ownership. No street-level digging is required. But like its pricier fiber optics competition, it offers a wide range of broadband transmission capabilities. The challenges for real estate providers Real estate providers turn to DAS to improve internet accessibility and performance for renters and tenants. Renters demand high speed internet, and the demand shows no signs of slowing down. According to the National Multifamily Housing Council Resident Preference survey, 93% of renters rate reliable cellphone reception as a top interest. About 55% of respondents view high-speed internet as a necessity. Additionally, 74% of renters are interested in community Wi-Fi. In the multi-tenant commercial environment, broadband connectivity is among the top three features that tenants require, reports the Building Owners and Managers Association (BOMA) International and the Urban Land Institute. Broadband connectivity is standard in new construction, and more than 50 percent of existing construction is retrofitted in some way to accommodate the technology,...

Changes in the Clouds

CIO + CFO Role Shifts

Cloud services have changed the roles of executives. CIOs implement fewer on-premises applications. Their technical infrastructure needs have evolved within the Internet of Things. CFOs now mold their capital expenditures pitches to address operations. In the center of those changes floats the cloud, and with it, the continually evolving roles of executives. The Balance Sheet caught up with Shawn Cardner, executive VP, multifamily operations and IT, Grubb Properties, to discuss the evolution on leadership. “The real estate industry, which arguably was slower to adopt technology, now can’t escape its influence,” explains Cardner. “Almost all multi-family marketing is digital, and big data now plays a role in many firms’ daily decision-making and long-term asset strategies. Firms that wish to remain competitive must integrate the CIO role into their overarching business strategy in order to reduce costs and increase revenue.” Benefits of the cloud for CIOs and CFOs The cloud offers several benefits for CIOs and CFOs, specifically. Scalable Solutions Through the cloud, CIOs can capitalize on features and services for small and medium-sized companies that were previously available to large companies. “Being able to play in the same sandbox as the largest of our peers allows us to be competitive in spaces where we might not otherwise be able,” says Cardner. Faster Implementations Finance teams are not dependent upon IT for support. As a result, implementations are rolled out with less friction during office hours and more work can be accomplished, faster. Specialized Software Support When using Yardi Cloud Services and Yardi Voyager to manage the general ledger, for example, the IT team does not invest resources in maintaining the accounting software. Updates and security are managed off-site by Yardi. Finance owns the application but supports the business processes in a more specialized manner. Cardner adds, “It’s worth noting that different challenges exist. There are fewer technical skills required of my team with a full-service solution like Yardi. There are, however, more nuanced soft skills and relationship skills required of us, which are sometimes difficult to find within technology circles.” Shorter Queues for IT With Cloud-based applications, there is less demand for IT to manage hardware or software. This often results in lower on-premises infrastructure costs. CFOs and their departments experience improved time to value, greater autonomy, and maintain ownership of software without being hampered by implementation or management during office hours. CIOs and their teams reduce hardware and software support, may decrease total cost of ownership, and can focus on specialized tasks. Addressing the risks Conversations about the cloud inevitably include risk management, security, and compliance. CIOs, CFOs, and COOs must collaborate proactively mitigate risks. “There is a tendency to recoil from the cloud when news of breaches occurs because of the bad press and notoriety. I’m reminded, however, of an IT saying, ‘The cloud is just someone else’s computer.’ An open port on a firewall turns an entire network into an unwanted cloud service, so diligence and thoroughness are necessary, regardless,” explains Cardner. He continues, “Modern security technology is quite robust, whether on-premise or in the cloud. The weak link of security in today’s age is people. Malware, ransomware, phishing and much of all data theft and loss are a result of improper employee conduct or inadequate employee training. When vetting a new cloud provider, that’s where my focus lies.” The future of leadership The value of infrastructure continues to be an integral part of CIO responsibilities. Even with available outsourced and cloud-based solutions, CIO’s still need to consider infrastructure and its strategy fundamental to the job. Yet now more than ever before, CIOs are becoming strategists. The emphasis shifts to discerning which services an organization needs to thrive rather than focusing on infrastructure. “Traditionally, CIO’s were strictly service providers and, in many organizations, didn’t sit at the table where strategy decisions were made. However, the proliferation of digital technology across and within organizations now mandates a level...

YASC Asia 2019

Meet Yardi in Singapore

The Yardi Advanced Solutions Conference (YASC) returns to Singapore on Nov. 5 and will be bigger and better than ever. Yardi brings together real estate management professionals from across Asia for this one-day event. Come and discover the latest proptech innovations, interactive discussions, meet local and international experts, and network with industry peers. This a great chance to dive deep into Yardi Voyager and the ancillary software real estate professionals use every day. YASC is also a great opportunity to strengthen collaborative skills and network with industry peers. With interactive discussions, local and international experts, more networking time, and previews of new products and enhancements, this is an event not to miss. YASC Singapore is a fantastic opportunity for Yardi clients with portfolio presence in Asia to discuss technology platforms with the leadership, development and support teams. Reserve your spot today! Here’s what to expect at YASC Asia 2019: • Meet the Experts Attendees will hear from industry experts on market trends and technology innovations. Make valuable connections with Yardi’s product experts and discover new insights, tips and tricks for getting the most out of Voyager and other modules. With enhancements and innovations in the Yardi pipeline, hear about new products soon to be released in Asia. You’ll also get a firsthand preview of the new Yardi Elevate Suite for asset management. • Visit Knowledge Central New to YASC Asia, gain hands-on experience with Yardi’s Knowledge Central, which will offer on-site assistance with Yardi products, SQL scripting and reporting. The Knowledge Central team will be available to answer your product-specific questions, provide previews of new products, discuss current software and anything else you’re keen to learn more about. For Knowledge Central hours, refer to the in-app schedule. • Yardi Events App A new addition...

Chasing Excellence

IREM Global Summit

Real estate industry leaders and professionals are heading to San Francisco on September 23-26 for the 2019 IREM Global Summit. IREM is the largest organization dedicated to advancing the profession of real estate management, and Yardi is a proud sponsor of IREM’s must-attend annual event which hosts approximately 800 top real estate management professionals from across the U.S. and around the world. “The IREM Global Summit provides a fantastic opportunity for real estate managers to get together and prepare for exciting new opportunities and challenges facing our changing industry. Yardi is proud to participate in this important event and share our innovative solutions including Yardi Elevate for big data that drives results for commercial and residential managers pursuing excellence,” said Esther Bonardi, vice president of marketing at Yardi. IREM has designed the event to expand knowledge through educational sessions that support professional growth and leadership development. Attendees come from the U.S. and Canada, China, Japan, Korea, South Africa and Brazil and gain value meeting with colleagues to build camaraderie and stronger relationships. Read on for the top three ways to connect with Yardi at the IREM Global Summit. Attend Educational Sessions This year’s schedule features 19 hours of educational sessions to empower attendees to move their careers forward. Sessions are based on real-world situations that property managers face daily, from opportunities to use technology to work smarter to difficult interpersonal scenarios. Don’t miss a potentially life changing session sponsored by Yardi. Join the famous sketch comedy group Second City for “Facing Forward: Using Improv to Embrace the Future” on September 26 at 8:15 a.m. In this fun interactive workshop, improvisers will lean into moments of uncertainty to see them as pure potential and will learn improv techniques to help them embrace the future and...

Pedestrian Power

New Yardi Matrix Study

“Big city” usually evokes buses, motorcycles, metro trains and cars. Beyond looking pretty and offering temporary respite from the bustle, does walkability—the ability to walk from home to shopping, dining, entertainment and employment spaces—add tangible value? Very much so, according to a new report that Yardi Matrix joined forces on with industry, academic and advocacy leaders. The Center for Real Estate & Urban Analysis (CREUA) at the George Washington University School of Business sponsored a study this year to rank the 30 largest metropolitan areas in the U.S. by how much office, retail and rental multifamily space lies in walkable urban areas. Multifamily rental asking rent data from Yardi Matrix went into the four-month effort, which also included contributions from real estate services firm Cushman & Wakefield, community quality-of-life advocate Smart Growth America, and real estate developer and investor coalition LOCUS. Yardi also contributed a $10,000 grant to support the research. The CREUA study identified 761 regionally significant walkable urban places, or “WalkUPs,” in those 30 metros. New York City has the most walkable urban real estate, followed by Denver, Boston, Washington, D.C., Chicago and San Francisco. The report documents that: Income-producing real estate (office, retail and rental housing) in walkable urban places has a 75% per square foot rent premium over other such real estate in the metro area. For-sale homes within WalkUPs have a 90% premium compared to the regional median for-sale home price in the metro area. The per-capita gross domestic product of the highest-ranked walkable urban metros is 52% higher than that of the seven lowest-ranked metros. “There is a ‘Doppler shift’ toward walkable urban development in the 30 largest U.S. metros,” Dr. Tracy Loh, senior data scientist at the George Washington School of Business and co-author of the report,...

AI, Examined

CRE's Machine Learning Future

Editor’s note: The following article by Kevin Yardi, vice president of consulting practices for Yardi, was originally printed as a Realcomm Advisory on May 31, 2019. It is reprinted here with permission. Various aspects of big data, AI and Machine Learning have been reported extensively in this space and elsewhere. I’ll use this opportunity to highlight some key points that I think are particularly important to helping the commercial real estate industry benefit from these capabilities. Just what are we talking about? “Big data” means large, complex data sets that most traditional software platforms can’t manage. AI refers to computer systems that can perform tasks normally requiring human intelligence. Machine learning, a form of AI that enables systems to “learn as they go” without being explicitly programmed, supports informed decision-making by assembling and analyzing property information more quickly and more accurately than other systems. The expansion of digital data availability, computing power and software enhancements, along with cheap storage, have made these options viable for commercial real estate. What are the commercial real estate benefits of AI and Machine Learning? AI and Machine Learning can give companies better-structured data that improves business performance. For example, AI systems can detect patterns in conditions affecting energy consumption without being requested, then optimize the target temperature every 30 seconds to ensure comfort without using more energy than necessary. They can also learn from past performance to react to changes in occupancy, weather and other factors. All this translates into better performance through lower utility, energy and equipment maintenance costs; increased tenant comfort that reduces service calls and increases retention; regulatory compliance; investor satisfaction; and higher ENERGY STAR® scores. In short, AI saves energy and money while creating more comfort than humans could do on their own. More...

7 Must-Have Apps

For Real Estate Pros

There are thousands of apps that claim to make your job easier. Since it is impossible to try them all, we’ve narrowed down the options for you! These seven apps complement the social media, communication, and content creation features on Yardi’s RentCafe suite. Social Media Instagram is one of the fastest growing social media platforms in the US. Once you get the basics of creating a post, these apps can take your social media strategy to the next level. When users visit your Instagram profile, they can see multiple posts at once in a grid layout. Polish your profile with Planoly, a visual planner that allows you to create the most beautiful and impactful grid. You can also benefit from the app’s engagement data for each post. Instagram Stories is woefully awkward. Creating informative and engaging 15-second clips on your smartphone requires a lot of choppy starting and stopping. Fortunately, CutStory for Instagram does the work for you. Create a single, full-length video and CutStory will divide it up for you. This is a great tool for repurposing your YouTube and Facebook videos. Communication Video calls are an excellent way to conduct personalized property tours and meetings with remote clients. Google Duo is a versatile app for video calls that works for Android and iOS devices. You can even use it over WiFi, minimizing data usage. Content Creation Create professional-looking images with Afterlight 2. This free photo editing app features text, filters, and enhancement tools for eye-catching images. It offers comparable quality to subscription apps and can be used on iOs, Android, and Windows devices. As a blogger, I know how difficult it is to get people to stop and read! Infographics are a hot way to share information in easy-to-consume snippets, enhanced with...

Industrial Strength

Matrix Market Report

Yardi Matrix took a close look at the U.S. industrial real estate market’s performance in the first half of 2018 and found plenty of positive signs. Indications of the sector’s strength include: Strong demand for space driven by year-over-year e-commerce sales growth of 15.4% Nearly 125 million square feet of industrial space coming online 7% year-over-year rent growth A national vacancy rate below 5% in the first quarter, the lowest since 2010 Commercial real estate-leading investment volume “Demand is stronger than ever” in every industrial subsector, the report says, with warehousing, manufacturing and flex space accounting for most of the occupancy gains. Demand was strongest in California’s Inland Empire, followed by Chicago and New Jersey. The industrial sector continued to benefit from rising e-commerce sales, which totaled $120.4 billion in the second quarter alone and drove the need for distribution centers near dense population areas. Over 90% of the first half’s new supply was warehouse and distribution space, with more than 238 million square feet of additional space under construction at mid-year. In markets where available land for development is scarce, developers focused on renovation and site remediation projects, expecting to recover costs with higher rents. Industrial rents continued to increase in most markets, spurred by the exceptional demand and lack of excess space in the top logistics markets. Rents averaged $6.29 per square foot at mid-year, up 7% year-over-year. “Expect rents to further increase through 2018 as the quality of available inventory improves due to upgrades and addition of new space,” the report says, noting that a slight deceleration might follow in 2019 as projects now under construction add to available inventory. The national industrial vacancy rate, 4.9% in the first quarter, was largely due to companies snapping up space before it was...

Self Storage Update

From Yardi Matrix

The self storage industry has been strong over the last several years, with economic growth creating new households and driving demand. Can this pace continue or will the recent supply surge outpace demand? That question formed the basis of a recent web presentation by Jeff Adler and David Dent, vice president and senior real estate market analyst, respectively, for Yardi Matrix. Their discussion focused on four areas: Macroeconomic Outlook The U.S. economy is in very good shape, Adler and Dent reported, with gross domestic product growing, inflation under control, and a tight labor market “pulling people off the sidelines,” although trade and immigration policies could brake the growth. Their research reveals that millennials and Baby Boomers are leaving big cities such as New York, Los Angeles, Chicago and Miami in favor of smaller, lower-cost cities with concentrations of intellectual capital work, which in turn drives storage demand. Destination metros include Dallas-Fort Worth, Tampa, Fla., Atlanta and Charlotte, N.C., along with retirement favorites such as Las Vegas and smaller mountain metros in the Appalachians and the Rockies. However, rental market fundamentals are faltering, with only 12 of 133 markets studied by Yardi Matrix showing year-over-year rent increases in September 2018, versus as many as 41 in previous years. Profile of Current Supply and Demand Domestic migration patterns have made Las Vegas, Tampa, Phoenix, Orlando. Fla., and Columbus, Ohio, the most attractive metros for self storage providers, Adler and Dent reported. The national average of self storage projects under construction and planned as a percent of existing inventory is 9.5%. Portland, Ore., Nashville, Tenn., Orlando, Boston and Seattle have the highest percentages. Approximately half of storage customers are in the process of moving while the other half are long-term users. Adler and Dent noted that approximately...

Reimagining Investment...

Asia market insight

Editor’s note: The following post was written for real estate and investment professionals in Asia by Bernie Devine, Regional Director (Asia) for Yardi. With 30+ years’ experience dedicated to real estate and technology, Bernie is a leader in digital transformation in real estate and using data to create a more competitive and collaborative environment. He supports real estate clients with Retail, Commercial, Industrial, Residential and Mixed Use assets, helping them to grow their operations, create efficiencies, and gain better insight into their business. His expertise includes asset and investment management, private equity, operations improvement, program and project management, finance, technology implementation and compliance. Currently responsible for the growth of Yardi Systems in Asia, Bernie lives in Hong Kong and is a qualified accountant and economist. He has published over 60 articles and has extensive public speaking experience. I’ve recently seen a lot of discussion around the tokenisation of real estate investments. Some has been sensible, but some has missed a few key points. Two key challenges of the real estate market for the last 400 years when compared to other investment asset classes are the slow pace of transactions (it takes a long time for ownership to be transferred) and liquidity (the purchase price is so large that only a limited market of buyers exists). There have been many innovations over the years (Such as private equity funds and REITS) that have sought to address these issues, but the proptech community now thinks it may have a better solution. Tokenisation of real estate investments is about changing the way ownership of an asset is represented. It’s proposed that this change in ownership model will open up how the purchase of the asset is funded and how ownership is transferred. Basically, if ownership can be...

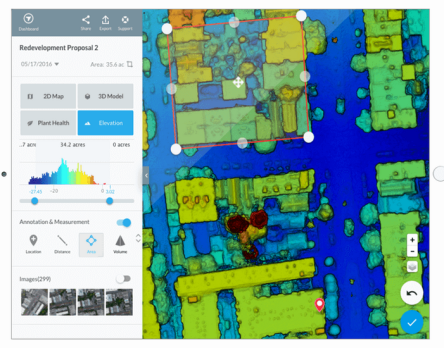

Drones that Map

Applications for Real Estate

Last year was the most significant year for commercial drones yet. More than 66,000 remote drone pilots were certified by the FAA in 2017 in the U.S. alone. Drones made their way into a diverse range of industries, from archaeology to construction, insurance to agriculture. Of course, millions of dollars have been invested in drone services, but Goldman Sachs estimates that the commercial drone market industry will surpass $20 billion by 2021. One of the hottest drone products of the moment is the mapping service. DroneDeploy, a company founded in 2013, recently launched Live Map—the world’s first software able to generate drone maps in real time. Usually, creating a drone map takes time—first you have to plan a mission, fly, capture imagery, go back to your desk to upload the data on your computer (it must be a suitably powerful computer) and then play the waiting game. For hours. With the new service, those hours of waiting disappear—even without a laptop or even internet connection, you get the data you need immediately. The steps are simple: plan a flight, take off, look at maps render on-screen during flight. That’s it. Hundreds of acres of land can easily become consumable maps, shareable to collaborators via instant cloud-syncing across devices. Thus, if more in-depth analysis is required, users can also create higher-resolution 2D maps from the same flight data. Live Map is the next-generation product of Fieldscanner, but it’s five times faster, which makes it capable of keeping up with the real-time challenges of the real world. “Hours of waiting for crop imagery are over. We can capture real-time data in seconds without an internet connection, and begin making smarter crop management decisions before the drone hits the ground,” says Justin Metz, technology integration specialist at...

YASC ANZ 2018

Expanded Training in Sydney

The Yardi Advanced Solutions Conference (YASC) returns to Sydney on August 29-30, bringing together real estate professionals from across Australia and New Zealand. Diving deep into Yardi Voyager and the ancillary software you use every day, this is a great opportunity to strengthen your skills and network with your peers. With interactive discussions, local and international experts, more networking time, and new innovations revealed, this is one event you can’t miss! As one attendee shared about their YASC experience in 2017, “I come to YASC to learn more about the systems that helps me in my role. This includes best practices, new functionality that improves my work days, and discovering system efficiencies.” Why will you attend in 2018? Here are a few new features to 2018 YASC Australia and New Zealand: Yardi Events App We’ve added a conference app to streamline your YASC experience. You can access all conference information, venue maps, class materials, social networking and in-app messaging and more on the Yardi Events app. It’s designed to enable attendees to custom-tailor their daily schedule with classes, demos, panels and roundtables, and to set up one-on-one meetings with Yardi staff. The Yardi Events app is available for download at the Google Play Store and Apple App Store. A browser-based version, synced to the mobile app, will also be available, so attendees can access all these features from their desktop. User log-in details have been emailed to all registered YASC attendees. Questions? Email our team at [email protected]. Hear from the Experts Throughout the conference, attendees will hear from industry experts on the market trends and technology innovations that impact our work. We’re excited to partner with MSCI, who will provide a real estate sector update and what’s ahead for Australia and New Zealand in 2019. You won’t want to miss this presentation during lunch on the first day. With...

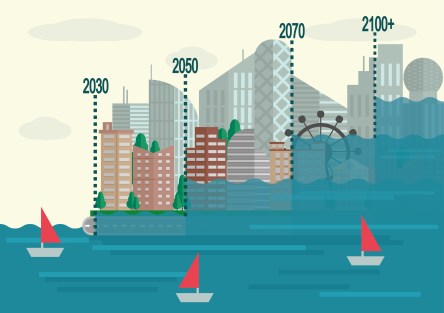

Rising Concern

Sea Level Impact on Real Estate

Intense climate and weather-related events, such as hurricanes, hail and ice, heat and wind and inland flooding, are occurring around the world with alarming intensity. Three hurricanes in 2017 alone caused a combined $300 billion in damages. About 5 million people in the U.S. are within 4 feet of a local high-tide level. A United Nations report in 2016 noted that climate-related events could place real estate assets valued at $35 trillion at risk by 2070—about half of today’s global assets under management in any industry sector. By one estimate, a sea level rise of six feet would imperil U.S. coastal properties worth about $900 billion. How can real estate asset managers prepare for what could be an inevitable rise in sea levels and other manifestations of climate change? “Asset managers and investors already have access to energy efficiency data from providers like Yardi. Now they need project-level natural hazard data that includes climate change projections. This is something the climate resilience field is working on, with a variety of firm jockeying to be first with the rollout of their proprietary software,” says Joyce Coffee, president of Climate Resilience Consulting and a senior sustainability fellow at Arizona State University’s Global Institute of Sustainability. Some cities, such as Cedar Rapids, Iowa, are countering weather damage risk by building flood control systems. Other metros, like Philadelphia, Detroit and Washington, D.C., have increased sewage fees, spurring building owners to consider adopting more stringent water conservation efforts. Many other officials and private citizens, of course, focus their efforts on identifying and mitigating sources of climate change. Real estate investors, for their part, are incorporating climate risk into their analysis and avoiding risky investments. A whitepaper released by BlackRock in 2016 noted, “Investors can no longer ignore climate change....

Build to Rent

Yardi UK Think Tank

Just a few years ago build-to-rent (BTR) was a rarely used phrase in the UK. Now it is one of the hottest real estate sectors around. A think tank of leading experts convened by Yardi and Property Week discuss the extent to which BTR has matured, the challenges it still faces and where the sector will go from here. The Think Tank Panelists: Andrew Cook – investment manager, M&G Real Estate (AC) Lora Salomidou – product owner, The Collective (LS) Rebecca Taylor – investment director, Long Harbour (RT) Katherine Rose – director of data & advisory services, Prsim (KR) John Dunkerley – chief executive and co-founder, Apache Capital (JD) Russell Markou – head of PRS operations,Tipi (RM) James Pargeter – projects director, Greystar Europe (JP) Chair: David Parsley – contributing editor, Property Week (DP) DP: How far along is BTR to becoming a mature market and is it now considered an institutional-grade investment? JD: There’s a big difference in people’s perception of where they think it is and where it actually is. There are 110,000 BTR units under construction or in planning. I don’t think we’re really scratching the surface yet. I don’t think it’s as advanced as people think it is. LS: The Collective has come from a slightly different angle to BTR and is focusing more on the consumer. The main reason we have got to where we are with BTR is because there has been a fundamental change in the expectations of consumers. The investors’ point of view is slightly different, but if we compare the return on investment from BTR to build-to-sell it is very different, because investors don’t have to manage the property – companies like us do it. JP: It’s certainly not yet mature in terms of finished...

Great Expectations

UK Retail Real Estate

LONDON – The evolution of the retail store in the face of growing online sales has been much written about, but shopping centres also can’t afford to be left behind in the age of ecommerce and changing technologies. This Retail Week report – produced in association with Yardi – explores how retailers view shopping centres and ways that centres can create an environment in which retail doors not only remain open, but thrive in a digital era. Based on interviews with 50 retail directors responsible for store portfolios – each representing a company with a turnover of between £50m and £10bn – the report finds strong similarities in what retailers want from shopping centres, and reflects changing shopper habits. Key themes are explored around how shopping centres can better support retailers, including expectations about infrastructure for technology and data, as well as how they can attract new entrants. The right mix between retail, leisure and dining is a fundamental attraction, while providing wi-fi is a prerequisite for retailers setting up shop in malls, which has both customer-facing and operational benefits. The future opportunities for shopping centres to enhance their performance, while diverse, are all underpinned by robust data. Decisions are increasingly data-led, and while current platforms – typically management software and spreadsheets – for data sharing have been well-received by retailers, there’s a strong feeling centre owners could provide more information. In particular, they want detail about footfall, dwell time and average spend, to better understand the local catchment and to adapt store space accordingly. Common themes for shopping centre investment over the next 12 months, according to our surveyed retailers, include keeping up with new technology, integrating ecommerce and opening new stores – all of which are elements that new entrants such as...

Realcomm at 20

Industry Leaders Honored

Commercial real estate education and event organization the Realcomm Conference Group LLC (Realcomm) celebrated its two-decade milestone by honoring 20 visionaries at its annual conference in Las Vegas. The prestigious group of honorees included Yardi founder and president Anant Yardi, who received a Lifetime Achievement Award recognizing his career-long accomplishments in real estate and technology. Realcomm also recognized the following industry leaders: Jesse Carrillo, SVP and CIO, Hines; Dave Clute, Chief Marketing Officer, ESD; Maureen Ehrenberg, President, Global Integrated Facilities Management, JLL; Robert Entin, EVP and CIO, Vornado Realty Trust; John Gilbert, EVP, COO and CTO of Rudin Management; Mark Golan, VP of Real Estate and Workplace Services, Google; Don Goldstein, former SVP and CISO, Digital Technology, CBRE; Hari Gunasingham, Founder, Sigma Sustainability Institute; Tama Huang, Principal and Global Real Estate Advisory Services Leader, NOI Strategies; Sandy Jacolow, CIO, Silverstein Properties; Ted Maulucci, President, SmartONE Solutions; Scott Morey, Executive Director of GPG Advisers; Paul Oswald, Managing Director, CBRE; John Petze, Principal, SkyFoundry; Wayne Pryor, Principal, 2Five1 Consulting; Joseph Rich, SVP and CIO, Related Companies; Darrell Smith, Director, Central Facilities Operation of Google; James Whalen, SVP and CIO, Boston Properties; Scott Zimmerman, CIO, CenterPoint Properties. The award criteria included consistent focus on real estate innovation and contributions to the industry for more than 20 years. Mr. Yardi founded his company in 1984 in Santa Barbara, Calif. Since then, it has become a global real estate software leader, and now has over 6,000 employees in 40 offices worldwide. “Anant is a constant supporter of Realcomm’s vision for uniting technology, innovation and real estate operations. His thought leadership, service to the industry and technology innovation over the years have been profoundly impactful,” said Jim Young, co-founder and CEO of Realcomm. “Realcomm has done a remarkable job enhancing...

Managing Risk

Vendor Screening from Yardi

Property owners and managers now have a new tool for making their communities safer places—VendorShield, Yardi’s new automated vendor screening platform. VendorShield lets property owners and managers define their requirements for insurance coverage, professional licenses and background checks. The system follows the custom rules for searching government watch lists and other national and local verification sources to ensure suppliers meet requirements. Regular auditing ensures ongoing compliance. With credential screening automated and insurance data auditing outsourced to the Yardi compliance team, property staff members have more time for their core responsibilities. VendorShield also simplifies management of Form W-9s, certificates of insurance, service contracts and other documents. “VendorShield helps facilitate safe communities for residents, tenants, vendors and staff,” said Terri Dowen, senior vice president of sales for Yardi. “The full integration of VendorShield with Yardi Voyager and VENDORCafé provides a convenient one-stop shop for vendor management.” Download a brochure to learn more about how VendorShield helps reduce risk and promotes a supportive community...

Bidding Wars

In Surprising Cities

Need to motivate your customers? Use your blog or newsletter to notify prospects that your property stands in one of the hottest, burgeoning markets in the nation. Perhaps they know that—they are already interested in buying in the area–but do they know about the local bidding wars? Bidding wars aren’t limited to the large cities any longer. Secondary markets are now seeing their fair share of dueling offers. To encourage faster response times from your prospects, share some of the interesting content below: Explain a Bidding War For your content to have the greatest impact, you’ll want to ensure that you clients understand the definition of a bidding war. To be concise, bidding wars take place when multiple buyers submit offers over the asking price in a desperate effort to secure the property for themselves. A higher asking price is only part of the battle tactic. Remind buyers that there are other concessions and considerations that can sweeten the deal for sellers. How Did Your City Make the List? Honestly, most buyers won’t care how your market made the list. But just in case they ask, here is the rundown. Realtor.com examined 150 cities where homes are selling above their asking prices. The organization kept tabs on these locations from 2015-2018 to solidify the trend before adding the city to the list. That means that these cities have been getting hotter and hotter for years now. Your clients better get ready to rumble! 5 Top Ranked Cities for Bidding Wars 1. Akron, OH Share of homes selling above list price: 20.6% Increase in the share of homes selling over list price: 91.7% 2. Worcester, MA Share of homes selling above list price: 41.5% Increase in the share of homes selling over list price: 88.1%...

5 Hottest Markets

For Senior Housing

In many cities, senior housing growth has plateaued. Over saturated markets have led to stagnant occupancy rates. According to the National Investment Center for Seniors Housing and Care, 2017 ended with the national occupancy rate at 88.8 percent, down 70 basis points year-over-year. The greatest stagnation takes place in markets with low barriers to entry, such as Atlanta, Dallas and Denver, reports CBRE. Yet there are markets that are still ripe for investment. They come with their own challenges but they stand a greater chance of success. Below are MoneyRate.com’s five best bets for senior housing investment. California San Diego and San Jose offer plenty of opportunities for construction and development—once you get past the high barriers to entry, like high land costs and low availability. It can take years for a project to break ground but once it does your class A property can thrive. Arizona This dry desert state has done a marvelous job of absorbing new supply. Occupancy rates remain high, leading analysts to believe that there is more room for growth. Florida The sunshine state remains popular with seniors. More seniors live in Florida than anywhere else in the United States. Their life expectancy is third-highest in the nation, meaning there are plenty of golden years in need of beautiful abodes. Maine The northern gem ranks among the top five states for retirement. It ranks just after Florida in terms of its senior population. The state offers low crime rates and relatively low to moderate land prices, which can help keep housing prices affordable for seniors. Washington Seattle is the wildcard of the list. National Real Estate Investor lists the city due to its increase in construction and the presence of major tech giants—assuming retirees want...

Tech Culture Shift

At Lowe With Yardi

Los Angeles-based Lowe is a leading national real estate investment, development and management firm in the commercial, hospitality and residential property investment sectors. In its 46 years the company has developed, acquired or managed real estate assets across the U.S. valued at more than $28 billion. Lowe manages commercial properties for institutional clients and joint venture partners. Challenges in managing portfolio growth and demands from clients for efficient service and profitability prompted the company to adopt Yardi Voyager in March 2013 The Balance Sheet asked Cindy Pearl, Lowe’s vice president/property operations controller, for a status report. Q: How has Voyager impacted your business? Pearl: I’ll offer just a few examples of how Voyager saves time on transactional items: Cutting an entire step by reversing charges and having the zero-cash receipt automatically apply itself. Saving a day of work for my cash receipts person by doing automatic application of pre-paids. Automatically sending A/R reports to our property management teams three times a month. The ability to enter multiple charges to one tenant on one screen is brilliant. We don’t have to apply pre-paid rents to the next month because they’re auto-applied. And we don’t have to do a zero-receipt batch for reversed charges. I love the flexibility, the analytics and how far you can drill down. Q: What aspect of Voyager stands out the most in your mind? Pearl: Its value to us goes far beyond numbers. Its effects aren’t measured just in time savings but in improved work attitudes and morale that come from eliminating multiple repetitive tasks. Voyager has produced a cultural shift by empowering our property management teams to collect receivables information and act on it on their own without help from corporate Q: You’ve been with Lowe more than 30 years. What would you like people to know about the company? Pearl: Lowe has a strong, values-based culture that encourages people—like me—to build our careers here. Beyond that, the thing about Lowe that has always amazed me is that we’ve survived all the business down cycles. We always come out of them. I think that says something about our tenacity, our management philosophy and our adaptability. Q: Back to Voyager—what else does it do for you? Pearl: It’s an amazing amount of information that people can turn into financial sense. I can run a transaction register for one tenant on one rent charge, or a tenancy report that shows everybody in a building with a renewal clause, all in one place. We can give appraisers, lenders or brokers a snapshot rent roll, custom rent roll, abstracts and tenancy schedules without having to pull out 140-page leases. We’re no longer spending hours figuring out a renewal. It’s like window-shopping: you can decide what you want, click a few buttons and get the report. Sometimes you almost don’t have to think for yourself anymore. It’s almost like breathing; it just happens. I almost can’t remember a time without Voyager. Learn more about Lowe....

Rental Market

Ontario Update

If you’re a Canadian property owner, manager or renter, here is the scoop from this year’s Ontario Rental Market Overview & Outlook. Hosted by Canada Mortgage and Housing Corporation and Federation of Rental-Housing Providers of Ontario, the market survey results were presented at the FRPO & GTAA (Greater Toronto Apartment Association) Rental Market Update Breakfast that took place on February 8, 2018. Industry leaders attend these sessions to gather key analytical data about marketing and rent trends along with policy updates for the apartment and purpose-built industry. CMHC’s Ted Tsiakopoulos, regional economist, and Dana Senagama, principal, market analysis for the GTAA, spoke about the new data released in this year’s report. While the presentations focused on Ontario, the report also includes information about other provinces. Keep reading for some key takeaways. Tightening Up Since 2015, Ontario’s economy has been growing faster compared with the rest of the country, and it’s not surprising that Ontario and British Columbia are still the tightest rental markets. Toronto is experiencing record low vacancy rates, influenced by the job market, demographics, cost gap, expectations and new rental supply. Due to lack of supply and slow building, the GTAA also reports accelerated rent growth – up 4.2%. The expectation is that vacancy rates still have room to fall – and rents will keep growing. Regarding housing types, there’s a higher domestic investment in condos, with 32.7% of condo units rented in 2017 (compared to 30.1% in 2015, and only 18.8% in 2008). Condo rentals significantly outpace apartment rentals. Rentals show a flattening out in the growth trajectory, and new building trends, there is the added challenge of lengthy construction timelines (up to three years). Shifting Demands With renter households outgrowing supply, demand in Ontario is shifting to less expensive housing....

Merging Traffic

Real Estate Asset Performance

In September 2016, real estate became the 11th Global Industry Classification Standard sector. Morgan Stanley Capital International Inc. and S&P Dow Jones Indices, which maintain the standardized classification system for equities, described the action as reflecting the “growing importance of real estate in the world’s equity markets” and “the position of real estate as a distinct asset class and a foundational building block of a modern portfolio, rather than an alternative.” The GICS classification means real estate asset performance is no longer blended into a larger financial picture but stands fully accountable on its own merits. This has prompted many companies to capitalize on real estate’s status as an increasingly viable asset class. For example, Cousins Properties Inc. completed the spinoff of Parkway Inc. into an independent REIT in October 2016. In March 2017, shopping center owner, operator and developer Regency Centers Corporation merged with Equity One Inc. to form a $16 billion company. Government Properties Income Trust acquired First Potomac Realty Trust for $1.4 billion later that year. Alex Stanton, Yardi’s industry principal for commercial, offers insight into best practices for participating in the growing mergers and acquisitions trend. The following are his thoughts on how to prepare: The increasingly common exchanges of real estate following the GICS designation aren’t the exclusive province of the big players; it’s happening with medium and small real estate companies as well, including enterprises that are family owned and operated. Mergers and acquisitions hold high potential to benefit shareholders, staff and customers of the newly created entity—but only if the organizations involved put the right strategy and assets in place. Here are some ways to do that. Put People First A company may be privately owned and dreaming of being a REIT, or planning to open funds...

Atlanta’s Auto Boom...

Real Estate Growth Abounds

Within the past 5 years, metro Atlanta has welcomed multiple international automotive companies. The rise of the automotive industry results in additional commercial development for the growing region. PSA Group PSA Group, parent company of Citroen and Peugeot, is the newest arrival to Atlanta. Automotive News reports that the French automaker is already recruiting in the with hopes of opening its American headquarters in February. For a company that is opening its doors next month, PSA Group has been silent about the details of the site. It is safe to say that the headquarters will not be new construction, though details of the deal in one of DeKalb County’s existing high-rise have not been forthcoming. PSA Group products will not be available until 2026. The company is currently in its development stages, focusing primarily on US compliance standards and market research. Analysts are anxious to see if the arrival of PSA Group will stimulate growth seen near other automotive developments. Mercedes-Benz The 200,000-square-foot Mercedez-Benz headquarters, on the other hand, is hard to miss. Groundbreaking took place in 2016 and the building is scheduled for occupation in March. Roughly 1,000 employees from the temporary headquarters in nearby Dunwoody will relocate to the new 12-acre site in the spring. The aesthetic of the $93 million building, located in the suburb of Sandy Springs, champions simplicity: clean lines, a muted color palette, and bright spaces. The structure, mostly glass, was inspired by biophilic design. “No person sitting in this building will be more than 30 feet from daylight,” says Gensler Principal Stephen Swicegood of MBUSA. The headquarters will be equipped with a fitness center, and a day care center with extensive outdoor playground. Adults can play in the walking trail nestled amongst nearly 800 trees. “We’re very pleased...

Scotland Build to Rent Market

Yardi Think Tank Update

The rise of the build-to-rent sector is changing the way we live – but gaining support from local authorities is critical to its success. Now firmly established in London, Manchester, Birmingham and Leeds, the market is also taking off in Scotland – but how is this market different, and what are the challenges for investors and developers? Yardi brought together a panel of industry thought leaders to discuss the main issues. Iain Murray, managing director, LIV Consult Dan Cookson, digital innovation consultant, Homes for Scotland Christa Reekie, commercial director, Scottish Futures Trust Rick de Blaby, deputy executive chairman, Get Living London Peter Carus, associate, GVA Claer Barrett, Financial Times (chair) CB: How does the Scottish build-to-rent market differ from England’s? IM: Looking at demographics, earnings and the overall rental market, Scotland is not that different from Leeds, Manchester or other big English cities outside London. Lots and lots of people rent. The difference is that Scotland, at the moment, is behind the curve. The Independence Referendum [in 2014] created a great deal of uncertainty, which held the market back. Talk of a second referendum had the same effect. If that were to start up again, investors would begin to get nervous. For now, investors seem to have got over Brexit and the ‘indyref’ – their money has to be put somewhere. PC: The key difference is that build-to-rent is taking its time to get going in Scotland. At a national level, there’s clearly been a big push. Now that’s beginning to come down to local government level and the planning authorities are supportive of new build-to-rent projects. RdB: The further you get from London and the South East, the more open for business local authorities are. The planners in Glasgow have been very receptive, and the new planning advice note that has recently come from the Scottish government is very useful too. IM: It does help that Scotland has a majority government too. CB: How are Scottish leases different – is this a problem for investors? RdB: The Scottish residential lease is distinctly different. When a tenant leases an apartment, effectively they have indefinite security of tenure. That might put some investors off; it certainty doesn’t put Get Living off as our model seeks to accommodate longer resident commitments anyway. IM: As a build-to-rent management company, our clients want people to stay for as long as possible. Turnover in tenancies costs money. CR: The Scottish system creates a lot of certainty for tenants that simply doesn’t exist in England. IM: Scottish leases are something that will put investors off if they don’t do proper research. Some build-to-rent investors will have an endgame of eventually selling the flats they develop. And they still can. There are extensive grounds for ending a lease and evicting the tenant; reasons include that you are selling the property, it is being refurbished, they have broken the tenancy agreement, they are being anti-social. As a build-to-rent management company, we are quite keen on this legislation as it gives me additional security. But from a conceptual point of view, investors outside Scotland may find it difficult – anything different from the norm, and some investors will think it’s easier to put my money in Manchester or Birmingham. CB: How have you changed your business model for the Scottish market? RdB: There are three, possibly four, cities in Scotland where build-to-rent could work. We have bought a 7.5-acre site to the east of the Merchant City in Glasgow, and we’re about to submit a planning application for 727 private rental with 99 student units. Our model is all about scale – we don’t do under 500 units. It is tempting to take what works in London and replicate it. But our focus groups in Glasgow have provided some valuable insights. For example, renters up here in Scotland don’t do as much apartment sharing as those in...